Today we’re diving into all the nuances of the long-term lease, the pros and cons, and why engaging long-term property management can build a win for you, your residents, and your investor clients.

Related: State of Resident Experience Study

What is a long-term lease?

A long-term lease is a lease agreement that lasts longer than the standard in an industry. In commercial real estate, long-term rentals could be ten years or more.

In single-family homes, a long-term lease could be anything more than one year. Long-term leases have the benefit of locking in payment for however long the lease lasts. It benefits property managers by guaranteeing cash flow and reducing vacancy, though with less frequent lease renewals, you may not be able to increase the price as often as you feel you need.

The concept of a long-term lease agreement may spark some preconceived notions among professional property managers. Locking a new tenant into their rental agreement for two-plus years seems like something of a gamble where you bet on the quality of the resident and the value of the lease remaining high. While it’s true that this type of lease comes with some tradeoffs, many PMs don’t see the positives, which have begun to outweigh the risks in an evolving market.

Benefits of a long-term lease

A long-term residential lease can offer several benefits for residents, property managers, and owners. Let’s get into the details:

Stability

With a long-term lease, residents have the security of knowing that they can stay in their home for an extended period, often one or two years, without having to worry about the possibility of the owner deciding to sell the property or not renew their lease. This can be particularly important for families or individuals in single-family residences who want to establish roots in a community and avoid the hassle and expense of moving frequently.

Predictable expenses

With a long-term lease, residents know exactly what their rent will be for the duration of the lease, which can help them plan their budget and avoid any unexpected rent increases. Similarly, property managers and owners can count on a steady stream of rental income, which can help them plan their expenses and investments.

Reduced vacancy rates

A long-term lease can help property owners and PMCs reduce the vacancy rate of their properties by providing them with a stable, reliable resident who is committed to staying in the property for an extended period of time. This can save time and money that PMs would otherwise spend trying to find new residents and dealing with turnover.

More responsible residents

Long-term tenants lease are often more committed to taking care of the property and being responsible “tenants.” This can lead to fewer damages, less maintenance, and a better overall experience for both residents and property managers.

Better creditworthiness

A long-term lease can also help residents build their credit score by establishing a history of paying rent on time and staying in one place for an extended period. This can be a particularly useful perk for young adults or those who are just starting to build their credit history. With Second Nature’s Resident Benefits Package, they can receive the benefit of getting their on-time payments reported to credit bureaus.

Overall, a long-term residential lease can offer a range of benefits and create a Triple Win for property managers, owners, and residents. However, it's essential to establish clear terms of the lease to ensure that it meets everyone’s needs and expectations.

Liabilities of a long-term lease

Of course, along with benefits, long-term lease liabilities exist as well. The primary drawback of long-term management is that you need to be more certain that the lease – and the resident – are the right fit for you and your investor.

A few things to consider before starting with a long-term lease apartment or long-term lease house:

- Ensure you do a thorough background check and credit check for all renters

- Ensure the lease clearly outlines behavior that could lead to eviction

- Be prepared that it may be more difficult to transition a difficult resident out

- Account for the fact that you won’t be able to raise the rent as easily or quickly as with a short-term rental

Long-term lease vs. short-term lease

A residential long-term lease and a residential short-term lease differ primarily in their duration, with long-term leases generally lasting for a year or more and short-term leases lasting for less than a year.

Below are some of the main differences between the two types of leases.

Duration

As mentioned above, the primary difference between a long-term and short-term lease is the length of the lease term. A long-term lease typically lasts for one or two years, while a short-term lease can be as short as a few weeks or as long as 11 months.

Flexibility

Short-term leases are generally more flexible than long-term leases, as they allow residents to move out relatively quickly if they need to. This can be useful for renters who are unsure about their future plans or who need to move frequently for work or other reasons. Long-term leases, on the other hand, provide more stability and predictability but can be less flexible if the resident needs to move out before the lease term is up.

Rent amount

The cons of short-term leases are they can be more expensive than long-term leases month-to-month, as owners or property managers can charge a premium for the flexibility they offer. Long-term leases generally have lower monthly rental rate, but residents are required to commit to paying that amount for the entire lease term.

Renewal

Long-term leases typically include a renewal clause, which allows residents to extend the lease term beyond the initial period. Short-term leases may or may not include a renewal option, and residents may need to negotiate with the PM or owner to extend the lease or agree to a new lease.

Maintenance

Long-term leases often place more responsibility on residents for maintaining the property, as they are expected to stay in the property for an extended period. Short-term leases, on the other hand, may include more maintenance services from the property management company, as they are more likely to have turnover between residents.

Long-term lease examples

A long-term residential lease typically refers to a lease agreement between a resident and an owner that lasts for a year or more. Below are some examples of long-term residential leases.

One-year or two-year lease

A one-year lease is the most common type of long-term residential lease. It lasts for a period of one year and requires the tenant to pay rent on a monthly basis. Two-year leases are less common but still fairly standard.

Multi-year lease

In some cases, owners may offer a lease agreement that lasts for three, four, or even five years. This type of lease provides residents with a high level of stability and predictability, but it may be less flexible than shorter-term lease options.

Corporate lease

Some companies may lease a property for their employees on a long-term basis, typically for several years. This type of lease often requires the company to pay the rent directly to the owner.

Lease-to-own

This type of long-term residential lease allows residents to rent a property for an extended period with the option to purchase the property at the end of the lease term. This can be a good option for residents who are not yet ready to purchase a home but want to establish roots in a community.

How the long-term lease helps investors

Gregg Cohen of PWB Properties is one of the property managers leading the charge on the long-term lease. PWB has positioned itself as a different kind of property management company, one that's focused on helping investors achieve their highest possible return on investment.

"As with most things in life, if goals aren’t aligned, one party typically loses. In “normal” property management, this is an unfortunate truth as well. It’s a shame that so many potential investors who see the incredible opportunities for earning above-average risk-adjusted returns on investment passively in rental property investing are so fearful of a poor property manager and resident relationship that they give up on their investing journey before they even start. At JWB, we are not trying to be “better” at property management. We are DIFFERENT."

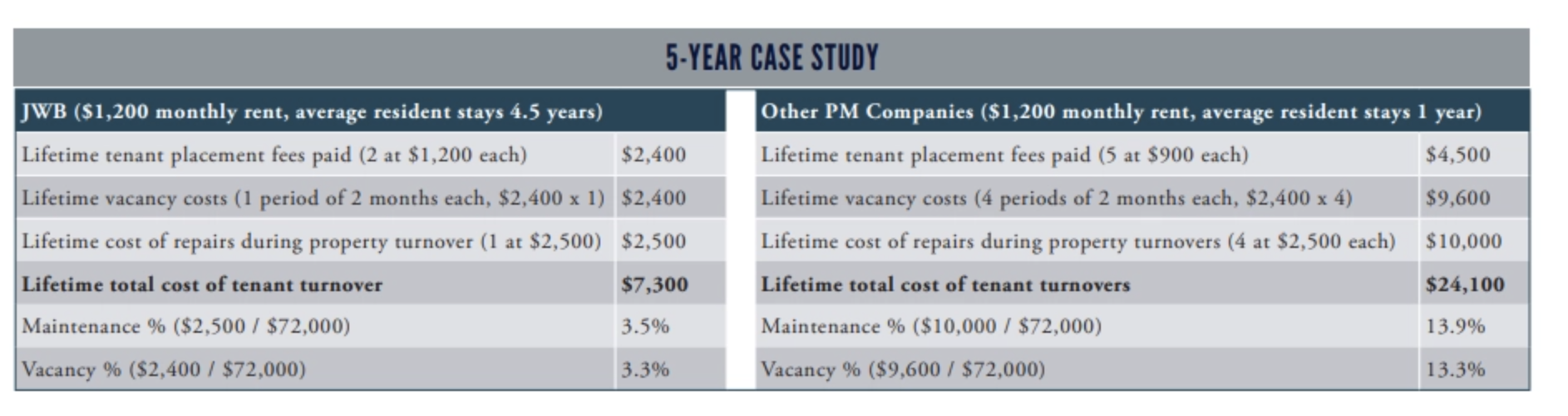

JWB is successful because they have perfectly understood how to create a Triple Win in an environment that is increasingly demanding of a relationship-focused property management strategy. As a property management company that offers far more than just plain old management of properties, they've built a business model that is extremely attractive to investors, part of which includes the long-term lease. Note their 5-year case study below on the financial results for the investor of signing residents to long-term leases.

The key takeaway is the dramatic decrease in fees paid by the investor. These numbers may scare you at first. JWB is willingly forfeiting profit from tenant placement fees, and quite a bit of it. Understanding the context of this decision is critical though, lest you end up playing catch-up with the rest of the industry over the next decade. JWB's commitment to their investors creates so much value that the growth of their business and retention of clients offsets the short-term profit decreases from this strategy. Property management strategies and business models built around short-term profit from things such as tenant placement fees will lose whatever staying power they're clinging to over the upcoming market cycle. Those types of companies will struggle to attract clients and many will eventually go out of business. JWB has proactively avoided being swallowed by the commoditization of the industry by offering something more personalized, relationship-driven, and value-creating.

As mentioned, JWB is focused on long-term investors that intend on growing their portfolios, holding properties for at least a full real estate market cycle, which is typically 10 to 20 years, and are intending to create income via real estate investment over a long period of time. The returns for these investors are diminished by property vacancies, so note the vacancy percentage decrease with JWB's long-term model versus the high-turnover model.

All of these benefits come together to provide clients with longer-term, goal-focused property management instead of short-term profit-focused property management, which is differentiating JWB right around the time that property management is becoming commoditized. It creates an enormous amount of opportunity to sign a large number of long-term clients by providing something that isn't otherwise available, creating a sustainable business model ready for consistent growth and prepared to sustain threats such as commoditization and do-it-yourself property management technology.

The longer lease is just one element of this triple win, but it's a significant one. As the case study notes, the dramatic decrease in costs is very attractive to investors. However, the long-term lease only works if the residents are willing to sign such a lease. So let's make this double win into a Triple Win.

How the long-term lease helps residents

Uncertainty has been a big theme over the last two years, mostly as a result of the coronavirus pandemic throwing the SFR space into quite a predicament. PMs have certainly taken some hits as a result with eviction moratoriums, residents being furloughed, and other challenges. But residents are experiencing significant challenges of their own as a result of the uncertainty they’ve experienced within their jobs, their ability to pay rent, and the potential of changing rent.

These are problems, but problems demand problem-solvers, and problem-solvers create solutions that end up differentiating their business. The long-term lease is proving to be that solution for many PM companies. The stability that it provides is proving to be a welcome sight for residents. Knowing where they will be in three years and exactly what their rent will be is valuable to residents who are fearful of a changing market, and the percentage of residents who see that value is continuing to increase. The result is one of the best resident retention tools out there.

For the PM, this doesn’t mean that rent is stuck. Rent adjustments are still possible, but they’re baked into the lease from the start. This allows the PM to plan for a changing market while giving the resident notice of pending changes prior to them signing the lease. Residents are much less likely to react negatively to rent increases if they signed off on them before ever moving in.

“Stability starts with helping them understand what their financial responsibilities are going to be years in advance. That’s where it starts and that’s a big reason why residents do like long-term leases.”

People find value in knowing where they will be in 3 years. A long-term lease is a commitment for a resident, but it's one that JWB has found that many are willing to make. Implementing a long-term lease program isn’t for everyone, but it’s proving an effective method for creating a Triple Win by creating stability, something everyone is after in these uncertain times.

Topics: