Resident Benefits Package: What it is and how to roll it out

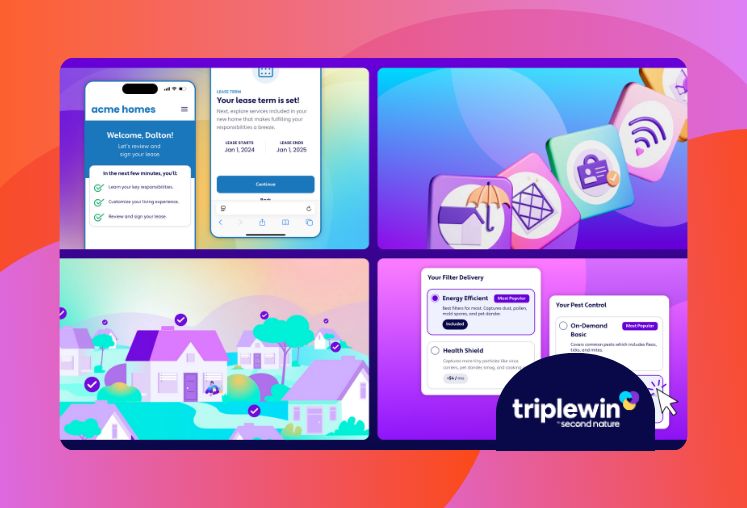

What is a Resident Benefits Package? A Resident Benefits Package (RBP) is a selection of services provided by property managers to residents of rental properties. Sometimes referred to as a “tenant benefits package,” these benefits are usually included in the lease agreement and are designed to make residents’ lives easier by meeting their wants and needs. Some examples of these services could include filter delivery, credit building, and 24/7 maintenance. At Second Nature, we pioneered the only fully managed resident benefits package. If you’re ready to get started, you can start building your own Resident Benefits Package today! Note: We chose the term “resident” because the “tenant benefit package” sounded too impersonal for the value we’re driving. At Second Nature, we think of residents as the focus of the rental experience, and using the term “resident” emphasizes the human aspect of property management. What are the benefits of a Resident Benefits Package? The resident benefits package adds value to residents by anticipating their needs and providing them with services that make life easier and better. It adds value to investors by preventing maintenance requests, vacancy, and delinquency. And, of course, it adds value to property managers because it differentiates them from the competition. Let’s take a deeper look at how the RBP creates a triple win – for residents, for investors, and for you, the property manager. 1. Attracting and retaining residents through better experiences Offering a comprehensive benefits package can make a property more appealing to potential residents. By providing desirable perks such as exclusive discounts, concierge services, or access to credit reporting and other financial benefits, the property management company can attract a larger pool of prospective residents and increase occupancy rates. Retaining residents is also crucial for profitability, as turnover costs can be significant. A benefits package can enhance resident satisfaction and loyalty, reducing turnover and associated expenses. 2. Higher rental rates for higher value A well-curated resident benefit package makes properties more valuable. When residents perceive additional value in the form of amenities, services, or discounts, they are often willing to pay more for their living experience. This allows the property management company to command premium prices for their units, leading to increased revenue and improved profitability. 3. Differentiation and competitive advantage In a crowded real estate market, a distinct resident benefits package can set a property apart from competitors. It becomes a unique selling proposition that highlights the property management company's commitment to providing an exceptional living experience. By offering a package that exceeds what other properties in the area provide, the company gains a competitive advantage and attracts residents who value the added benefits. 4. Ancillary revenue opportunities A Resident Benefits Package can create opportunities for generating additional revenue streams tied to specific benefits in the package. Resident benefit fee: Understanding pricing and value Most resident benefits packages cost between $20 and $100, which is often included in the lease and added as a monthly fee for the resident. Prices vary depending on a few key factors, chief among them being the mix of benefits selected by the property manager and the market they’re operating in. What does a Resident Benefits Package include? Here’s what the Second Nature Resident Benefit Package includes. Filter delivery service Air filter delivery was the first service Second Nature offered to scattered-site and single-family property managers. It is a cornerstone of the RBP, and over 1 million residents have shown that a physical, tangible product is key to their ongoing perception of value. One of the most common causes of HVAC maintenance requests is a failure to change the home’s air filters on time. In fact, changing filters on time can drive a 38% reduction in HVAC-related work orders! Air filter delivery from Second Nature solves the problem by delivering the correct-sized high-quality HVAC filters directly to each home’s front door on a predetermined schedule. The delivery serves as a reminder for the resident to change the filter, and voila – problem solved. The resident breathes clean air, the PM has fewer HVAC tickets to deal with, and the investor has their asset protected. That’s a triple win. Our message to residents: “Changing filters is as easy as opening the front door.” Phil Owen, founder of OnSight PROS, says of the delivery system: “Last year OnSight PROS performed third-party property condition reports at almost 18k single-family rental properties on behalf of property managers. The number of filters that we have to replace or mark as ‘needs attention’ becomes almost zero when a PM implements the Second Nature program. I cannot imagine how a property manager could justify not protecting their landlords with this program. The difference between those using the program and those who simply hope that their tenants go to the store to purchase and install a new filter is staggering.” $1 million identity protection One in three Americans will be victims of identity theft. In 2021, digital theft incidence surpassed home burglary incidents for the first time, and today, digital crime accounts for eight times more losses than home burglary, according to the FBI. With identity protection as part of your RBP, every adult on the lease automatically gets the peace of mind you can expect from professional-level identity protection. Backed by AIG and monitored through IBM’s Watson, Aura Identity Guard works proactively on behalf of the resident to identify fraudulent use of their identity and alert them. In the event of an actual identity theft case, the resident receives a dedicated case manager and is covered up to $1,000,000 for most resulting damages. This protects the resident's ability to pay rent, which makes it a win for the investor. And it keeps property managers out of the middle of another difficult situation. Related: How to Help Residents Use Their Identity Protection Services During a Data Breach Credit Building With RBP’s credit building service, on-time rental payments improve the credit score of your residents. It may seem crazy that people are building credit by paying for Netflix and other small subscriptions, but not their largest monthly payment... rent! But that's the truth for most residents. We asked, how is it even possible that someone's largest monthly expense is the only one they aren't getting credit or rewards for? This credit reporting program reports positive-impact, on-time rent payments automatically to all three credit bureaus, helping residents build their credit simply for paying their rent on time. Residents also get an immediate boost with 24 months of back reporting included. On average, we’ve seen residents improve their scores by 64 points in the first year of enrollment, as outlined in our 2026 Triple Win Impact Report.This can have a tremendous impact on interest rates when it comes to credit cards, auto loans, and future mortgages, incentivizing residents to get rent in on time and helping set them up for home buying in the future. The property manager and the investor both reap the benefit of the extra incentive to get rent on time, and the resident gets to see their credit score rise as a result of something they have to do anyway. It’s a big-time triple win here. Resident rewards program Rental rewards are a favorite among residents, and serve as another powerful and positive incentive for on-time rent payments. Rental rewards programs deliver automatic benefits at move-in. Then, residents can unlock even more rewards by paying rent on the day it's due. With Second Nature, all on-time payment tracking is done through the app. Like other services in your RBP, it’s managed for you. Residents can save up their rewards points and then cash in for things like: $30 gift card for national and local brands $25 restaurant card $40 rewards cash on rent day each month rent is paid on time And more The value of rewards is covered in the cost of the RBP, so the property manager isn’t seeing any additional liabilities. PMs and investors see an increase in on-time rent payments, and the resident now sees rent day as rewards day. Another triple win. Move-in Concierge Setting up utilities can be a massive headache for a new resident. Residents aren’t sure who to call for utilities and home services like electricity and TV for their new address. Moreover, researching discounts, promotions, and coupons takes more time. Typically, the process is clunky, with lots of friction that gets in the way of it getting 100% done. It’s no surprise that the 2025 AppFolio Renter Preferences Report found that most residents name setting up utilities as the biggest challenge when moving into a new home. Move-in Concierge changes all of that for professional property managers. In one phone call, residents find out what their best options are and can even get help simplifying setup. An experienced concierge confidently guides multiple people every day to properly set up their utilities. Renters Insurance Program Nearly all property managers require a renters insurance policy in their lease agreements. As part of our RBP, Second Nature offers price-competitive insurance coverage options through a Renters Insurance Program that property managers can apply to all their residents, locked in with one group rate. Residents who have their own renters insurance can still use it, but that policy is tracked for you by Second Nature. If a resident cancels or fails to renew their own policy, they’re automatically enrolled in our master policy. No more frustrating insurance tracking for you, quality asset coverage for the investor, and immediate and comprehensive liability coverage for the resident – another triple win you can create with your Resident Benefits Package. Pest control services Pest problems are some of the most common complaints that property managers receive, and they can have devastating financial impacts for investors. With on-demand pest control services, residents contact a pest control company directly when there's an issue, and schedule a time for a treatment. Because there’s no cost to residents for up to four treatments per year, they won’t put off crucial services for fear of getting hit with a bill. No more nasty surprises at move-out, no more calls to your office, and no expensive preventative spraying that costs you a fortune. Group Rate Internet 98% of residents in the United States already pay for internet service. With Group Rate Internet, you can provide gigabit-speed internet to all of your single-family rentals at below market price. By negotiating a group rate with multiple internet service providers, Second Nature can get your properties connected even if they're spread out over a large area. Your residents pay for internet service right alongside their rent, so they don't have to juggle an extra monthly bill, and you get a new way to grow your business. Additional benefits At Second Nature, we help property managers deliver all their services to residents. If you’re already offering perks and are ready to level up to a Resident Benefits Package, we can help you bundle the above benefits with other services. We’ve worked with PMs to bundle in their existing property management services, including: 24/7 maintenance coordination: A huge benefit to residents and PMs is a service that provides after-hours support without dragging the property manager out of bed. This type of program makes reporting pesky maintenance issues easy and fast for the resident. It also helps prioritize emergency maintenance. Online portal: With a simplified online resident portal, residents can access all of their documents, messages, and more through an app. Residents can also pay rent and receive reminders to pay rent online. Home buying assistance: For residents who are building up toward home ownership, some PMs offer assistance in building credit and savings. We help them get there. Vetted vendor network: A vetted network ensures that vendors who service your properties are screened to exceed your standards for insurance, licensing, and professionalism on the job. Property managers, residents, and investors can rest easy knowing that they have the best vendors working on their assets. Washer/dryer rental: Some properties may have these appliances installed, or residents may come with their own, but we’ve seen the impact on prospective applicants choosing homes due to the convenience of having the washer/dryer available. Security deposit alternatives: Security deposit alternatives come in different packages, but all serve to provide residents ways to be financially liable for damages without having to pay a significant lump sum upfront. Pure insurance, surety bonds, and ACH authorization programs are all versions of deposit alternatives that seek to lower the barriers to rental, which in turn keeps days-on-market low and turnover costs down. When implementing a full-service, fully managed Resident Benefits Package, you don’t have to lose the benefits you already offer. A great service can integrate all of these benefits together – delivering more impact to residents, investors, and property managers. Resident Benefits Package ROI: How much revenue per unit? The amount of ROI on a Resident Benefits Package will vary depending on the property class, market, and number and type of services offered. Generally speaking, Resident Benefits Packages are often in the $25-75/mo range for residents, but could be more or less. It depends primarily on the amount and type of products and services. A Resident Benefits Package gives residents the kind of incredible experience that they will pay and stay for. Of course, keeping residents happy can reduce turnover and lead to lower costs and higher ROI for you and your investors. According to Eric Wetherington, VP of Strategic Initiatives at PURE Property Management, “Revenue is all about providing a service. The younger generations we’re dealing with in property management – they want convenience, they want experiences, and they want things to be simple, and they’re willing to pay to have things taken care of for them.” Today, property managers can typically generate revenue in two key ways: Increasing services to improve resident retention Decreasing costs by increasing efficiency A Resident Benefits Package can help to accomplish both. Routine filter delivery cuts down on HVAC and maintenance costs. A move-in concierge helps cut down time and cost as residents get settled in their new home. Credit building services keep residents invested in paying on time, sending online payments, and delivering incredible value. The list goes on. A resident benefits program creates a huge win for you as a property manager, and your investor, by driving higher ROI over time. How property managers can implement a Resident Benefits Package If a Resident Benefits Package is new to your company, you may wonder how best to implement it. Should you roll out a resident benefits package as part of your base service – ensuring the maximum benefits for your investor – or allow residents to opt in or out? We do recommend including an RBP as a part of the base package for all residents. Offering optional RBPs creates potential for headache, and the theoretical benefits almost never materialize. It’s important to look at the value that a resident benefits package brings to the investor and the resident, not just you as the property manager. At Second Nature, we’ve seen incredibly low pushback from residents when an RBP was introduced. After all, it’s designed to benefit residents, and most are delighted to have the extra level of service. How a Resident Benefits Package helps property managers reduce costs Implementing a comprehensive Resident Benefits Package can provide property managers with opportunities to reduce costs and increase operational efficiency. In fact, property managers save an average of 99 minutes per lease, thanks to the fully-managed nature of our RBP. Here’s a breakdown of some of the other ways PMs can benefit: By including air filter delivery as part of the package, property managers can ensure that residents have regular access to clean air filters, reducing the need for costly maintenance and repairs caused by poor air quality. Offering identity protection and credit-building services can help mitigate the financial risks associated with identity theft and delinquent payments, potentially reducing costs related to collections and legal procedures. They also improve tenant retention and encourage on-time payments. Including a resident rewards program can also incentivize desirable behaviors such as timely rent payments or positive referrals, fostering resident satisfaction and reducing turnover costs. By implementing a fully-managed renter's insurance program, property managers can offload potential liability and property damage expenses, minimizing their own financial risks. A move-in concierge service can streamline the onboarding process for new residents, reducing administrative costs and improving operational efficiency. By providing these benefits, property managers can improve resident satisfaction scores and retention, ultimately reducing expenses associated with turnover, repairs, and legal issues. Common mistakes to avoid when implementing a Resident Benefits Package In our experience helping property managers implement RBPs, we’ve heard our share of concerns (or even horror stories) from PMs who had bad implementations with other products. Here are some of the most common mistakes in RBP implementations – and how to avoid them! 1. Overpromising and underdelivering Property managers may advertise extravagant benefits that they cannot consistently provide or fulfill, leading to disappointment and resident or investor dissatisfaction. Property managers should accurately represent the benefits package, ensuring that the offered perks are realistically achievable and consistently provided to residents. 2. Lack of communication Failing to effectively communicate the details and availability of the benefits package to residents can result in confusion and missed opportunities for using the offered perks. Property managers should be crystal clear on the details and enrollment process for benefits, and should use multiple channels, like newsletters and online resident portals. 3. Inadequate research and selection Property managers may choose benefits that do not align with the residents' preferences or needs, leading to a lack of interest and underutilization of the package. Property managers should conduct thorough market research and engage with residents to understand their preferences and needs, ensuring that the benefits selected align with their expectations. 4. Failure to evaluate cost-effectiveness Neglecting to assess the costs and benefits of the package can result in offering benefits that are financially unsustainable or fail to provide a satisfactory return on investment. Property managers should regularly assess the costs and benefits of the package, considering factors such as resident utilization, return on investment, and overall financial sustainability to make informed adjustments as needed. 5. Lack of flexibility and adaptability Not regularly reviewing and updating the benefits package based on resident feedback and changing market trends can make it less competitive and less appealing over time. Property managers should actively seek resident feedback, monitor market trends, and periodically review and update the benefits package to ensure it remains competitive and relevant to residents' changing needs. 6. Insufficient staff training Failing to train property management staff on the benefits package and its administration can lead to ineffective communication, missed opportunities, and difficulty addressing resident inquiries or issues. Property managers should provide comprehensive training to their staff on the benefits package, including its features, administration processes, and effective communication strategies, enabling them to effectively support and engage with residents. 7. Neglecting legal and regulatory considerations Property managers must ensure that the benefits package complies with all relevant laws and regulations, such as data protection requirements or fair housing laws, to avoid legal repercussions. Property managers should consult legal experts or advisors to ensure that the benefits package complies with all applicable laws and regulations, protecting both the company and residents. 8. Ineffective marketing and promotion Inadequate marketing efforts to promote the benefits package can result in low resident awareness and limited participation, reducing the overall effectiveness of the package. Property managers should develop a strategic marketing plan that utilizes various channels to promote the benefits package, highlighting its value proposition and actively engaging residents in participating and utilizing the offered perks. 9. Lack of coordination with vendors Failing to establish clear communication and expectations with vendors offering benefits can lead to subpar service delivery, difficulty resolving issues, or missed opportunities for cost savings. Property managers should establish clear expectations, contracts, and regular communication channels with vendors offering benefits, ensuring a seamless and satisfactory service delivery process for residents and promptly resolving any issues that may arise. This is a lot to keep in mind, and avoiding these mistakes might feel like it will cost too much or simply take too much work. But that’s why opting for a fully managed RBP is a solution so many PMCs are turning to. You can rely on your partner to manage all aspects of your RBP, and ensure it's delivering on its promises to your residents. The best RBP providers go above and beyond, even providing resident-facing materials that can help you drive adoption, increase understanding, and minimize questions from residents. Activating your Resident Benefits Package through resident onboarding Getting residents enrolled in your RBP might seem like a daunting task, but Second Nature makes it easy with our new Resident Onboarding solution. When combined with your RBP, it creates a true Resident Experience Platform, allowing residents to better understand the benefits available to them. You can even offer customization based on the property type, location, and more. For example, you might offer higher grade air filters as an upgrade in case some of your residents have pets, asthma, or other respiratory factors. In fact, we’ve already seen 25% of residents opting to upgrade at least one benefit when given the option. That means your residents are getting benefits that are better suited to them, and it drives a little bit of extra revenue for you. Plus, when residents better understand their options and obligations, you see higher lease compliance and fewer violations. How 2,500+ property managers create triple wins with a Resident Benefits Package Rolling out a Resident Benefits Package is a powerful way for property managers to create a triple win – for residents, investors, and themselves. An RBP like Second Nature’s is designed to be simple to use and easy to implement. All the included services are managed externally by Second Nature, meaning there is no day-to-day upkeep required from the PM. You plug it in and Second Nature keeps it running. The value creation an RBP generates – with such little work required from the PM – is an incredibly easy way to grow your business and create great experiences that residents will pay and stay for. Don't get left behind in the evolving world of resident experience. Learn more about our fully-managed Resident Benefits Package and how we can build ease for you, your investors, and your residents. Learn More About RBP from Second Nature FAQ What is a resident benefits package in property management? A resident benefits package, or RBP, is a set of value-added services property managers include in the lease to improve the resident experience, boost retention, and generate additional revenue. It typically covers essentials like air filter delivery, credit building, renters insurance, and concierge support. How does a resident benefits package help property managers? An RBP increases efficiency by consolidating key resident services under one program. Property managers can reduce maintenance requests, improve on-time rent payments, and strengthen resident satisfaction—all while generating recurring ancillary revenue. Is a resident benefits package required by law? No, it’s not a legal requirement. However, it’s becoming an industry standard among professional property management companies because of its proven impact on ROI and resident retention. How much should a resident benefits package cost? Most RBPs range between $25 and $75 per month, depending on included services and market factors. The fee is added to the lease agreement and is easily justified when residents understand the convenience and financial protection it provides. What makes a fully managed resident benefits package different? A fully managed RBP—like Second Nature’s—handles all service coordination, billing, and support. Property managers don’t have to manage vendors or logistics, ensuring a seamless experience for residents and consistent value delivery across every property. Can an RBP improve resident retention and occupancy rates? Yes. By creating a better living experience and simplifying essential services, an RBP encourages residents to stay longer and renew leases, which reduces turnover costs and stabilizes occupancy. How do property managers promote an RBP to residents? Clear communication is key. The most effective property managers present the RBP as a convenience upgrade—emphasizing benefits like time savings, financial security, and exclusive rewards rather than just listing features.

January 8, 2026

January 8, 2026

Read more

October 15, 2025