Best Lease Management Software for Property Managers and Multifamily Operators

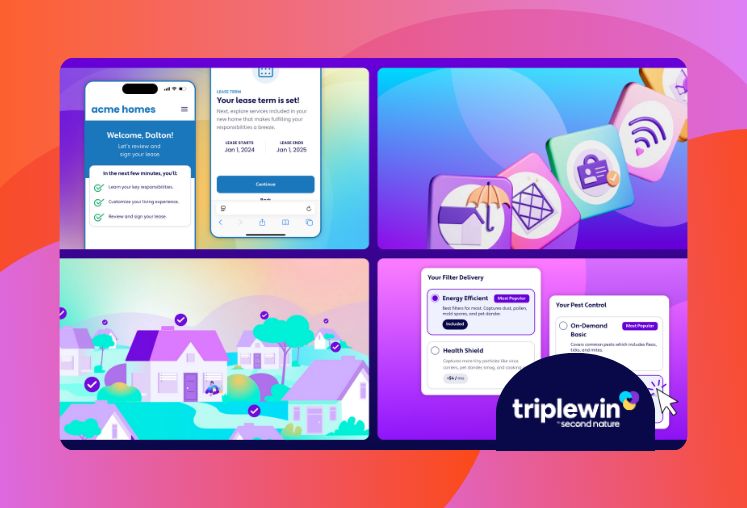

Effective lease management software solves one specific operational problem: eliminating manual tracking of lease expirations, renewal terms, and compliance requirements across portfolios where spreadsheets become unmanageable. In this article, we'll review seven lease management solutions: Second Nature, Buildium, AppFolio, Propertyware, Landlord Studio, DoorLoop, and RentRedi. We'll compare features, pricing, and ideal use cases so you can find the right fit for your portfolio size and property type. What is the best lease management software? Lease management software that justifies its cost centralizes document storage, tracks critical dates, automates renewal notifications, and maintains audit trails. The baseline functionality (what you're paying for regardless of platform) includes template-based lease creation, e-signature integration, automated expiration alerts, and version-controlled document storage. Platforms worth considering beyond baseline functionality sync bidirectionally with accounting software, generate renewal offers based on configured rent increase logic, and flag compliance requirements automatically. Portfolio-wide visibility becomes critical above 50 doors: you need a single dashboard showing lease status, renewal pipeline, and compliance gaps without opening individual property records. Property managers running 200+ scattered-site doors typically lose 12-15 hours weekly to manual lease tracking. Leasing coordinators check the property management system for expiration dates, cross-reference signed documents in separate storage (Dropbox, Google Drive, local drives), update master spreadsheets, and manually follow up on renewal offers. The coordination loop repeats weekly because no single system maintains current status. Automated lease management pulls expiration dates directly from lease records, triggers renewal notices 90-120 days before lease end, tracks resident engagement (email opens, portal logins), logs responses, and escalates non-responses after configured intervals. The 12-15 hours previously spent on manual tracking shifts to revenue-generating activities: touring properties, processing applications, coordinating move-ins. Seven best lease management software platforms compared Lease management platforms optimize for different operational profiles. A scattered-site single-family portfolio with multiple investors requires different functionality than a multifamily portfolio with standardized lease terms. Platform selection depends on portfolio size, property type mix, investor reporting requirements, and existing technology stack. Second Nature Second Nature integrates lease management with resident benefits rather than treating leases as standalone document workflows. The platform connects lease terms directly to service provisioning: when a lease activates, included benefits (like HVAC filter delivery, renters insurance, credit reporting, and utility coordination) are provisioned automatically without manual setup. Property managers can offer residents the choice to upgrade their lease enrolled services; for example, some residents might opt for higher-grade HVAC filters if a member of their family has asthma. The platform covers baseline lease management: document storage, renewal tracking, automated notifications, and compliance monitoring. The differentiation is lease terms trigger service delivery automatically. Lease execution triggers automatic service provisioning. A lease including HVAC filter delivery, renters insurance, credit building, and move-in concierge activates all four services when signed (no manual enrollment, no coordination across separate vendors, no follow-up to confirm activation). Lease termination ends services automatically. Second Nature offers a lease workflow that’s easier for residents to understand than a traditional PDF lease. By walking through each lease obligation and benefit, Second Nature helps residents engage with their lease, customizing options and understanding what’s expected of them during their residency. Automated date reminders and automations Second Nature provides reminders to residents who have not yet signed their lease. Second Nature also works directly with the property manager’s property accounting software to send out lease renewal documents when the time comes. Insurance lapses trigger automatic enrollment in backup coverage (typically included in RBP at $12-15/month), preventing the coverage gap that creates liability exposure. Billing adjusts automatically, with no manual follow-up required. Compliance tracking The platform maintains compliance documentation across all RBP services, including insurance certificate tracking, filter delivery confirmation, and credit reporting enrollment status. Owner compliance requests pull documentation directly from the system (no manual compilation from separate vendor records, no scrambling to prove coverage existed during a specific timeframe). Insurance compliance without automation means weekly certificate checks, manual follow-up on expired policies, and coordination gaps where coverage lapses before backup policies activate. Property managers typically discover lapses 2-3 weeks after expiration, creating liability exposure that owners rightfully question. Certificate monitoring with automatic backup enrollment closes the gap. When regulations change, Second Nature also allows property managers to push updates to their entire database of leases, rather than updating them individually to reflect new requirements. Document management and reporting Second Nature’s document management capabilities allow property managers to upload and tag leasing documents by property group. For example, they may have specific documents for single-family homes, and different documents for multi-family properties. Leasing agents can quickly upload addenda and other documents based on specific property conditions, like whether they have on-site laundry, whether appliances are included with the rental, and whether they have shared or individual utilities. Documents can then be sorted and updated based on their property group, and updates will automatically carry through to all new leases for properties in that group. Integration capabilities Bidirectional integration with property accounting software syncs lease terms, rent amounts, resident data, and billing schedules. Changes in either system update automatically: lease-enrolled services configured in Second Nature flow to accounting software, resident move-outs in the accounting system terminate services in Second Nature. Best for Scattered-site single-family and small multifamily portfolios where Resident Benefits Packages improve retention. The platform makes economic sense when RBP offerings (filter delivery, insurance, credit building) align with resident demographics: renters who value convenience services and credit-building opportunities show higher renewal rates. Pricing Second Nature's success-based pricing is based on portfolio size and which RBP services you include. The lease management capabilities come as part of the broader RXP platform rather than as a standalone product. Implementation timeline Fast implementation is a key differentiator for Second Nature, with specific timelines depending on portfolio size and historical data migration requirements. Dedicated implementation includes template configuration, integration setup, team training, and initial lease migration. Resident benefits are then enrolled on an ongoing basis as existing leases renew. Buildium Buildium has become the go-to all-in-one property management platform for independent managers and smaller PMCs. The lease management functionality integrates tightly with accounting, maintenance, and communication tools in a single system. All-in-one lease lifecycle management Buildium handles the full lease lifecycle in-house. You can create leases from templates, send them to residents for e-signature, store signed documents, track key dates, and automate renewal workflows. The system includes a library of state-specific lease templates and addenda, though you'll want your attorney to review them for your specific needs. Automated rent escalations and critical date reminders The renewal workflow in Buildium is straightforward and effective. The system identifies upcoming expirations based on your configured timeline (typically 60-90 days out), generates renewal offers with your specified rent increases, and tracks resident responses. You can configure automated reminder sequences that send follow-up emails to residents who haven't responded. For portfolios with consistent rent increase strategies, this automation works well. If you need complex escalation logic that varies significantly by property or owner, you'll handle it more manually. Compliance tracking Buildium tracks required disclosures by state and flags when leases need specific addenda. The system doesn't automatically update when jurisdictions change requirements. You'll need to monitor regulatory changes yourself or work with legal counsel. The platform does make it easy to apply updated terms across your portfolio once you're aware of changes. Document management and reporting All lease documents live in Buildium's document center with automatic organization by property and resident. The system maintains version history and provides audit logs showing who accessed or modified documents. Reporting shows lease expirations, renewal status, occupancy rates, and lease term analysis across your portfolio. Integration capabilities Because Buildium is an all-in-one platform, integration mainly matters if you're using specialized tools for specific functions. Buildium integrates with DocuSign for e-signatures and some third-party maintenance coordination tools. If you're using standalone accounting software, you'll need to evaluate whether Buildium's accounting module meets your needs or if you want to maintain separate systems. Best for Property managers with 20-500 doors who want a single platform handling accounting, leasing, maintenance, and communication. Buildium works well when your portfolio follows relatively standard lease terms and you don't need extensive customization for individual owners. Buildium struggles when you're managing 40 different investors with unique requirements. You end up maintaining 15 separate lease templates, manually selecting the correct one for each property. Pricing Buildium starts at $62 per month on their Essential plan. Implementation timeline For property managers starting fresh or migrating from purely manual processes, Buildium implementations typically run 2-4 weeks. If you're migrating from another property management platform, expect 4-8 weeks, depending on how much historical data you're moving and how complex your current processes are. AppFolio AppFolio targets larger property management companies and offers sophisticated lease management capabilities built for scale. The system handles complex lease structures, including commercial properties and mixed-use portfolios, alongside traditional residential leases. Enterprise-grade lease intelligence and automation AppFolio's lease management is built for complexity. The platform handles residential leases, commercial leases with complex escalation clauses, rent concessions, tenant improvement allowances, and multi-year terms with varied payment structures. The lease intelligence features automatically extract data from documents, populating key fields and making information searchable across your entire portfolio. This becomes increasingly valuable as you scale. Automated rent escalations and critical date reminders AppFolio's renewal and escalation logic is sophisticated. You can configure complex rent increase formulas based on CPI adjustments, market rate changes, property-specific factors, or resident payment history. The system can apply different escalation logic to different lease types or properties automatically. Critical date tracking covers everything from lease expirations to option exercise deadlines, with notifications routing to your team, owners, or residents based on rules you configure. You can add custom milestones specific to your operations beyond the standard rent escalation and insurance renewal reminders. Compliance tracking AppFolio maintains detailed compliance records and can track jurisdiction-specific requirements across different markets. The system flags when leases need specific disclosures or terms based on property location. Like most platforms, it doesn't automatically update when regulations change, but it makes applying updates across your portfolio efficient. Document management and reporting Document management in AppFolio handles large volumes without slowing down, maintains detailed version histories, and lets you control exactly who sees what. An owner can access documents for their specific properties without seeing anything else in your portfolio. You can also build custom reports that analyze whatever matters to your operation. The business intelligence tools surface patterns you might miss when looking at properties individually. Integration capabilities The system integrates with major financial institutions, various utility billing services, and numerous third-party tools. However, AppFolio works best when you're using its full suite. The platform prioritizes accounting, maintenance, leasing, and communication, all within the platform. Best for Property managers with 200+ doors, particularly those managing 500-5,000+ units across multiple property types. AppFolio handles the complexity of larger operations, mixed residential/commercial portfolios, and sophisticated reporting requirements that smaller platforms struggle with. The platform may make less sense for property managers with under 100 doors or those with very simple lease structures, unless you have plans to grow quickly. Pricing AppFolio doesn't publish pricing publicly, but it has a free trial for its three tiers of plans. Implementation timeline AppFolio implementations can run 2-4 months for mid-sized portfolios (200-500 units). As always, implementation time depends on the size of your portfolio and the complexity of data being migrated. Propertyware Propertyware focuses specifically on single-family and scattered-site property management. This makes it a strong fit for property managers dealing with individualized lease terms and geographically dispersed portfolios. Flexible lease management for scattered-site portfolios Propertyware's lease management emphasizes flexibility and customization. You can maintain unique lease templates for different owners while ensuring compliance and maintaining portfolio-wide visibility. The platform includes e-signature capabilities, automated document generation from templates, and document storage with version control. Automated rent escalations and critical date reminders: Renewal workflows in Propertyware are both automated and flexible. The system can run standardized renewal campaigns across your portfolio while allowing manual intervention when specific situations require it. Rent escalations can follow set formulas or be customized property-by-property. One investor wants aggressive rent increases on C-class properties but conservative increases on A-class to protect retention. Another wants flat $50 increases regardless of market conditions. Propertyware configures different escalation logic for each owner's portfolio while running automated renewals across all properties. Compliance tracking Propertyware tracks compliance requirements and lets you configure rules specific to different jurisdictions. The system can flag when properties in specific locations need particular disclosures or lease terms. You can also track owner-specific requirements to ensure each property meets its investor's standards. Document management and reporting Document management handles scattered-site operations with detailed audit logs and secure owner portals. Investors access documents for their specific properties without seeing your full portfolio. Reporting covers lease expirations, renewal status, and term analysis with customizable filters. Integration capabilities Propertyware integrates with numerous third-party tools, including various accounting platforms, tenant screening services, maintenance coordination systems, and payment processors. This flexibility lets you build a tech stack that fits your specific needs rather than being locked into one vendor's ecosystem. Best for Property managers with 100-2,000 doors in scattered-site single-family portfolios, particularly those managing properties for multiple investors with varying requirements. Propertyware handles the complexity of individualized lease terms without forcing everything into a standardized box. Pricing Propertyware starts at $1 per month, per unit. There are two additional tiers at $1.50 per month per unit and $2.00 per month per unit. Implementation timeline Typical implementations run 6-10 weeks, including data migration, template setup, integration configuration, and team training. The timeline can extend if you're moving from multiple disconnected systems or have significant data to move. Landlord Studio Landlord Studio targets smaller landlords and property managers with straightforward portfolios. The platform emphasizes simplicity and ease of use over functionality. Simplified lease management basics Landlord Studio covers lease management basics. Within the platform, the lease creation process is simple. You select a template, customize key terms, send it to the resident for signature, and store the signed document. The platform doesn't offer the sophisticated template management or complex automation you'll find in more developed systems. What it does offer is straightforward functionality without overwhelming features. Automated rent escalations and critical date reminders Rent increase capabilities are basic. You can schedule rent increases and the system will remind you when they're upcoming, but there's no complex escalation logic or market-based adjustment features. For portfolios with simple rent increase strategies (flat dollar amount or percentage each year), this works fine. Critical date reminders cover lease expirations and rent increase dates. The notification system is straightforward. You get reminders at intervals you configure, and you handle follow-up manually. Compliance tracking Landlord Studio includes basic lease templates by state, but doesn't offer sophisticated compliance tracking or jurisdiction-specific monitoring. You're responsible for ensuring your lease terms meet local requirements. Document management and reporting Document storage is organized by property with basic search and retrieval. Reporting shows upcoming lease expirations and renewal status, but doesn't offer the detailed analytics and business intelligence you'd find in more sophisticated platforms. Integration capabilities Landlord Studio offers limited integrations compared to more complete platforms. The system integrates with some payment processors and accounting software, but you won't find the extensive third-party connectivity of platforms like Propertyware or AppFolio. Best for Landlords and property managers with 1-50 doors who prioritize simplicity over sophistication. Landlord Studio works well if you have straightforward lease terms and want basic features without complex customization. Pricing Landlord Studio offers a free tier with limited functionality and paid plans starting at $12 per month. Implementation timeline Implementation is minimal. You can be operational in a few hours. There's little to configure and little training needed. DoorLoop DoorLoop positions itself as a modern, user-friendly property management platform for small to mid-sized portfolios. The offer is complete functionality with an emphasis on intuitive design. Clean interface matters when your team is entering dozens of leases weekly. If template selection requires navigating four menus and clicking through confirmation screens, your leasing coordinator spends valuable time per lease. At 40 leases monthly, you might spend 2 or more hours in unnecessary navigation. Modern and user-friendly lease workflows DoorLoop handles full lease lifecycle management, including document creation from templates, e-signatures, storage, and renewal automation. The platform includes a library of lease templates and addenda, with customization options for your specific needs. The user interface is notably clean and modern compared to some legacy platforms. A property manager could be up and running in DoorLoop within three days, compared to the two weeks with the previous platform they were using. Automated rent escalations and critical date reminders DoorLoop automates the standard renewal process from identifying expirations through escalating non-responses. Rent increases are configured as flat amounts or percentages. The calendar integration sends critical date reminders to your team and can be configured to notify owners of upcoming expirations for their properties. The notification logic is straightforward rather than highly customizable. Compliance tracking DoorLoop includes state-specific lease templates and tracks basic compliance requirements. The system flags when specific disclosures are needed based on property location. Like most platforms, it doesn't automatically update when regulations change, but it makes applying updates across your portfolio efficient once you're aware of them. Document management and reporting Document management is well-organized with automatic filing by property and resident. The system maintains version history and provides owner portals for investor access to documents. Reporting covers standard lease metrics with some customization options. Integration capabilities DoorLoop integrates with common tools, including payment processors, tenant screening services, and some accounting platforms. The integration ecosystem is growing, but not as extensively as more established platforms like AppFolio or Propertyware. Best for Property managers with 20-300 doors who want modern, user-friendly software without the complexity or price point of enterprise platforms. DoorLoop works well for managers who've outgrown entry-level tools but don't need the sophisticated functionality of AppFolio or Rent Manager. Pricing DoorLoop pricing starts around $69/month in their Starter plan. Implementation timeline Implementation typically runs 2-4 weeks for straightforward migrations. The user-friendly interface means training time is shorter than more complex platforms. DoorLoop provides implementation support and has strong documentation for self-service setup. RentRedi RentRedi targets small landlords and property managers with a mobile-first approach. The platform emphasizes functionality accessible from smartphones rather than requiring desktop computer access. Mobile-first lease management RentRedi covers basic lease management with document creation, e-signatures, storage, and renewal reminders. The platform is designed for mobile use, so the interface is simplified compared to desktop-focused platforms. Lease templates are straightforward and cover common residential situations. Customization options are more limited than other platforms, but sufficient for simple lease terms. Automated rent escalations and critical date reminders: Renewal reminders notify you of upcoming lease expirations, but the automation is basic. The system doesn't include sophisticated renewal campaigns or complex rent escalation logic. You'll handle most renewal communications manually, with the platform providing reminders and document management support. Compliance tracking RentRedi includes state-specific lease templates but doesn't offer compliance tracking or monitoring. You're responsible for ensuring lease terms meet local requirements. Document management and reporting Document storage is organized by property with mobile access. You can access lease documents from your phone, which is convenient for on-the-go property management. Reporting is basic because your upcoming expirations and renewal statuses come without detailed analytics. Integration capabilities RentRedi integrates primarily with payment processors for online rent collection. The integration ecosystem is limited compared to other platforms. Best for Small landlords with 1-20 doors who manage properties on the go and prioritize mobile access. RentRedi works well if you don't need sophisticated automation or customization, and you value being able to handle lease management from your phone. Pricing RentRedi offers plans starting at $5 per month, with a Growth plan billed at $29.95 monthly. Implementation timeline Implementation is minimal. The mobile-first design means less to configure and less training needed. Best lease management software: Key factors to consider Portfolio size and complexity Door count and lease complexity determine appropriate functionality. 30 simple residential leases require basic document storage and renewal reminders. 500 doors with varied terms, multiple property types, or commercial components require sophisticated automation, complex escalation logic, and robust reporting. Platform capabilities should match operational complexity, not exceed it. 15-door single-family portfolios overpay for enterprise features. 800-door mixed-use operations require sophistication that basic platforms can't deliver. Integration requirements If you've already invested in accounting software, maintenance coordination tools, or screening services, prioritize platforms that integrate smoothly. Ripping and replacing your entire tech stack rarely makes sense. Integration quality varies significantly. Bidirectional sync (changes in either system update automatically) eliminates manual reconciliation. One-way sync or periodic batch updates create reconciliation gaps. Third-party middleware connectors (Zapier, custom APIs) introduce failure points and maintenance requirements. Team capabilities and training time Consider your team's technical sophistication and available training time. The most powerful platform becomes useless if your staff can't or won't use it effectively. A PMC buys sophisticated software, spends $15,000 on implementation, and then half the team keeps using the old spreadsheet system "just as backup." Within three months, they have duplicate data everywhere, nothing matches, and nobody trusts either system. Owner expectations Some investors want constant visibility into their properties. Others trust you to handle details. Choose software that makes it easy to deliver the reporting level your client base expects. If you manage properties for 50 different investors who all want different reports and different access levels, you need a platform with effective owner portal functionality and customizable reporting. If you manage three investors who trust you completely and want a quarterly summary email, that sophistication is a wasted expense. Mobile access requirements Property managers conducting site visits, coordinating maintenance, or showing properties require mobile access to lease information, contact details, and documentation. Platform mobile capabilities range from full-featured apps (document access, signature collection, task management) to basic viewing functionality requiring desktop access for most operations. Growth trajectory Buying software purely for today's needs is shortsighted, but paying for enterprise features you won't use for five years doesn't make sense either. Look for platforms that can scale as you do without requiring complete migrations. Choose a platform that handles your current portfolio plus 50-100% growth. If you're managing 100 doors and plan to reach 200 doors in three years, make sure your chosen platform handles 200 doors effectively. But don't buy enterprise software designed for 5,000 doors if you're at 100 doors with no immediate plans to scale dramatically. Total cost beyond subscription fees Don't evaluate platforms on monthly subscription costs alone. Factor in implementation costs, training time, integration expenses, and the opportunity cost of learning curve inefficiency. A property manager in Nevada could choose the cheapest platform option to save $150/month compared to the alternative. Implementation then takes three times longer than expected, requires hiring a consultant, and her team will struggle with the clunky interface for six months. When calculating the true cost, she will have spent $12,000 more than if she'd chosen the slightly more expensive platform with better implementation support and user experience. Implementation practices for the best lease management software Start with clean data. Don't migrate messy data into a new system. Use implementation as an opportunity to standardize, correct errors, and establish better practices going forward. Review your lease templates before migration. Identify inconsistencies. Decide which version of the terms becomes your standard. Clean up your contact data. Verify resident information is current and accurate. This upfront work prevents months of cleanup later. Phase your rollout strategically. Consider implementing in stages rather than flipping a switch across your entire portfolio. Start with one property type or a subset of owners, work out the kinks, then expand. Pick your five most tech-savvy owners for phase one. Get their properties migrated, train their residents on the new portal, and work out any workflow issues. Once that's running smoothly, expand to the next group of owners. By phase three, when you're onboarding your most change-resistant owners, you'll have worked out all the problems and can show them proof that the system works from owners who've already transitioned successfully. Invest in proper training. Budget real time for training. Your team needs to understand not just how to use the software, but why the new workflows matter. The operations manager who's been doing things manually for 10 years won't change habits without clear reasoning. Set clear migration timelines. Establish specific dates when old systems will be retired. Running parallel systems "just to be safe" inevitably leads to duplicate data and teams reverting to old habits. Communicate clearly with stakeholders. Residents, owners, and team members all need to understand how the new system affects them. Will residents get a new portal login? Will owners receive different reports? Will team workflows change significantly? Manage these expectations proactively. Don't surprise residents with a new portal the day their lease renewal is due. Don't wait until an owner asks for a report to explain the new format. Why the best lease management software includes Resident Benefits Packages A Resident Benefits Package like Second Nature's creates opportunities within your lease management approach. An RBP connects lease terms directly to services residents value. When HVAC filter delivery, renters insurance, credit building, resident rewards, identity protection, and more are documented in your lease as part of a benefits package, several things happen: Instead of separate addenda for insurance requirements, filter change responsibilities, and utility setup procedures, you're documenting a single benefit package. Residents understand what they're receiving, and your lease terms are clearer. When filters arrive automatically at residents' doors every 60-90 days, you eliminate ambiguity around who's responsible for filter changes. A property manager can avoid a dispute that could cost $3,000 in HVAC repairs without the filter delivery being documented in the lease terms. A resident can claim the PM was responsible for all HVAC maintenance, including filter changes. But documentation shows installation remains the resident's responsibility. Residents who value tangible benefits like filter delivery and credit building are more likely to renew. Hive Real Estate saw 40% more on-time payments by adding perks and ease of access to the customer benefits package. From a lease management perspective, an RBP is a complement that makes lease terms more valuable to residents and easier to execute for property managers. Choose the best lease management software for your team and residents Second Nature connects your lease terms directly to services residents actually value. When you sign a lease that includes Second Nature's Resident Benefits Package, services activate automatically. The result is lease management that delivers tangible value and improves renewal rates while reducing the strain on your operations. Want to see how Second Nature can integrate into your lease management process? Book a free 30-minute demo and discover how connecting lease terms to resident benefits can increase satisfaction for your team and your residents. FAQ What is lease management software? Lease management software centralizes the entire lease lifecycle, from drafting through renewals and move-outs. It stores documents, tracks key dates, automates notifications, integrates with accounting systems, and maintains audit trails. Property managers see fewer missed deadlines, better standardized terms across portfolios, and demonstrated compliance on demand without manual tracking. How much does lease management software cost? Pricing varies significantly based on portfolio size and feature depth. Factor in implementation costs, training time, and integration expenses beyond subscription fees. Can lease management software integrate with accounting systems? Integration capabilities vary significantly by platform. Most modern lease management systems integrate with popular accounting software like QuickBooks, though integration depth differs. Some platforms like AppFolio and Propertyware offer native, bidirectional sync that automatically updates rent rolls and lease terms across systems. Others, like Landlord Studio and RentRedi, have limited integration requiring manual data transfer. Evaluate integration capabilities carefully before selecting software, as disconnected systems create more work instead of less. Do residents need to access the lease management software? Resident access varies by platform and your preferences. Most systems offer optional resident portals where tenants can view lease documents, sign renewals electronically, and access important information 24/7. This self-service capability can reduce your support burden and improve resident experience, but it can also lead to frustrating calls from residents who can’t access their portals. You can use lease management software effectively for internal operations even if residents never directly access the system. Mobile-first platforms like RentRedi emphasize resident access, while others focus primarily on property manager functionality. How long does it take to implement lease management software? Implementation timelines range from hours to several months, depending on platform complexity and portfolio size. Simple platforms like Landlord Studio and RentRedi can be operational within hours with minimal configuration. Mid-tier systems like Buildium and DoorLoop typically require 2-4 weeks, including basic data migration and team training. Platforms like Propertyware need 6-10 weeks for full implementation. Enterprise systems like AppFolio often require longer, including complex data migration, extensive configuration, integration setup, and team training. Time investment includes data cleanup, template standardization, workflow configuration, and testing before going live across your portfolio. What's the difference between property management software and lease management software? Property management software is a full platform that handles all operational aspects. Lease management software focuses specifically on the lease lifecycle, including document creation, e-signatures, storage, renewal automation, and compliance tracking. The choice depends on whether you prefer an integrated suite or best-of-breed tools for specific functions.

November 12, 2025

November 12, 2025

Read more

October 15, 2025