What we'll cover

Define your ideal target market

Clarify how you are built to serve those clients best

Use dog whistle language

Understand demand generation vs. demand fulfillment

The Buyer’s Pyramid

Track the numbers and optimize: Unit Acquisition Cost & ACV

Build the list and lower your costs

Sweat equity or check equity

Final Thoughts

Navigating the world of property management can often feel like a high-wire balancing act, particularly when it comes to property management lead generation. But fear not!

The path to success becomes clear when you understand your target market, communicate effectively, and employ savvy lead-generation strategies.

More good news: We know a guy who happens to be an expert in scaling up residential property management companies – Jeremy Pound, CEO of RentScale.

We reached out to Jeremy to talk about the ins and outs of how to approach successful customer acquisition strategies for residential property managers. In this article, he’ll help guide us through key steps, providing actionable insights to help you attract and secure your ideal property management clients.

Let's turn those potential leads into lucrative opportunities!

Meet the Expert: Jeremy Pound, CEO of RentScale

Jeremy Pound is the CEO of RentScale, the largest sales consulting and coaching company in the residential property management industry. They’ve trained over 400 companies on how to successfully grow their property management business by becoming “new customer machines.” He is also the publisher of Strategic PM - The Magazine for Property Management Entrepreneurs and Executives.

1. Define your ideal target market

Not every prospect is a fit. And the key to growth is targeting the right people with your marketing strategies.

When first starting out, a property manager might focus on pure hustle and price. But eventually, that’s no way to scale for profitability. (On that subject, Pound recommends the excellent management book, “What Got You Here Won’t Get You There,” by Marshall Goldsmith.)

“Something I talk about all the time is that the opposite of ideal fit client is a misfit,” says Pound. “You want to work hard to avoid those misfits, which means you need to label the right-fit clients, know who they are, and describe them. That's the best way to grow: not just getting more net clients, but getting better and better quality clients.”

In short, build high-quality leads by defining your ideal customer. Pound outlines the specific types of property management investor clients:

- Experienced investors: “There are different types of experienced property owners. Are you going after those who value risk aversion and peace of mind? Maybe you're charging a little more and adding more ancillary services, but you're protecting them from all the things that can go wrong. Or are you going after really aggressive risk-takers who are looking to optimize every dollar possible?”

- Accidental landlords: “Are you built to serve accidental landlords? Oftentimes homeowners move on, they move up, or they downsize, and they look to keep their very valuable properties as rental properties.”

- Working professionals: “Maybe you’re going after working professionals, such as high earners who are building a portfolio as property investors. They got the real-estate investing bug, they know that maybe they don't want to pull their money into 401K and index funds, and so they're actually using new property to build a portfolio for retirement.”

- Out-of-town investors: “Are you really built to serve out-of-town real estate investors? There are a lot of people, myself included, trying to build a diversified national portfolio of single-family rentals, and [some PMCs] are really built to serve that person because they need somebody local who's an expert and understands that local market.

Once you define your ideal customer, which is the most important step, everything comes from there, Pound says.

2. Clarify how you are built to serve those clients best

According to Pound, the simplest next step is to build your processes and procedures around that target ideal client.

“Everything we do should be a story around why all of our policies, our pricing, our procedures are all built to best serve that client,” he says. “I like to call this ‘avoiding the commodity tax.’ If you go out and spend money on advertising, or if you're buying new leads, or you're trying to spend money on SEO as if you're just a commodity and you've got nothing exciting to say – no sharp story, no compelling positioning – then you're basically paying the commodity tax.”

“You're going to have to buy all these leads, and most of those people are not going to buy from you,” he continues. “You might be buying 10 leads to close one deal, or you might be spending a bunch of money on advertising that's just going over everybody's head. Nobody's paying attention to it because it's not exciting.”

This brings us to the next strategy…

3. Use dog whistle language

Pound emphasizes that what catches our attention is the uncommon, the novel, and the specific.

Our marketing should cultivate that specificity. Here’s how:

“A term that we like to use around here is Dog Whistle Language,” Pound says. “If you know a dog whistle, only a dog can hear it. So when you know who your client is, it allows you to speak Dog Whistle Language – their language.”

“I always try to enter the conversation that's already happening in their mind. If we have a very specific client, we know the problems that they're trying to solve, we know the frustrations they have and the goals they have. So let's just enter the conversation that's already happening in their mind! That’s going to make your content marketing less expensive and way more effective, and it's going to make your sales process even better.”

“If we can say what our prospects are already thinking, but we can say it better with more clarity, then they're going to key into that.”

Ask yourself:

- What are they already thinking?

- What is the problem they're trying to solve?

- What are the frustrations they have?

Then, describe it even better than they can, says Pound: “That has been proven to create trust, to create authority. and to make them remember you.”

4. Understand demand generation vs. demand fulfillment

“We want all our clients generating demand for their service,” Pound says.

Demand fulfillment is “just going out and buying pay-per-click ads because people are already searching for your product.”

This is a commodity-based approach. Let’s say something needs a new roof. They’re just going to type “roofer Boca Raton.” Pounds says that’s demand fulfillment: “You're just fulfilling the demand that's there, right? You're just hoping to get lucky. You're spending as much money as possible and just showing up.”

Instead, Pound says, “Demand generation might be going out and talking to people about how if they've had any storm damage, they might be able to get their roof replaced through their insurance.”

“There's a lot of examples of this in property management,” Pound says, “especially when you're going out, and you're teaching people to invest in real estate – actually going out there and creating the market for your product. It's more sophisticated, but it's way more profitable, and you have way more control over that than just sitting around and playing the demand fulfillment game.”

Pound gives an example of a PMC going after high-net-worth individuals.

“Let’s say you’re in Florida, where Publix is headquartered, you might be going after all the executives at Publix. You’re basically saying, ‘Look, there are other ways to pay for your kids' education. There are better ways to save for retirement. You can live a better life if you get involved in real estate investing.’”

That’s demand generation.

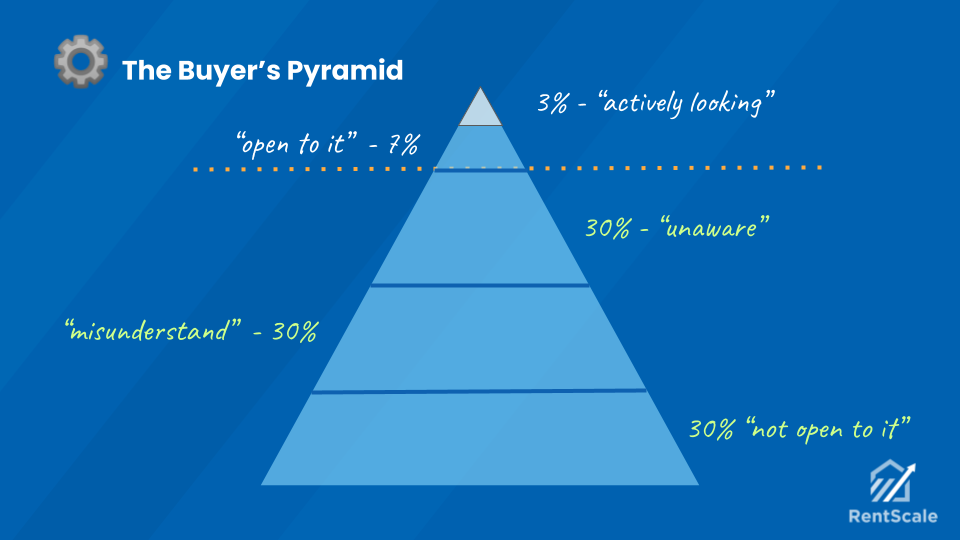

5. The Buyer’s Pyramid: Have campaigns for each level of the buyer’s journey

Time to get into the Buyer’s Pyramid.

The top 3% are in the demand fulfillment mindset. They know what they need, they’re searching for the service or product, and they’re ready to buy.

Then there’s 7% that are loosely open or becoming open to the idea of needing a product or service. As Pound says, “Maybe they're kind of frustrated with their property manager, but they're not so frustrated yet that they're ready to go search on Google.”

That’s the moment to hit them with direct mail, email marketing, cold calling, or messaging that enters the conversation that’s already happening in their mind. Pound says to aim to say what they were thinking better than they can say it. Then they may move up into the 3% who are ready to make a decision.

Below that is 30% of the potential market that isn’t aware of the existence of your product. They may be renting their homes or about to sell and simply don’t know that property management services exist.

Then there's another 30% of the market that just misunderstands. Pound elaborates: “Maybe they’ve been self-managing forever, and they think that property managers just take a piece of the pie rather than make the pie bigger.”

“Really good property managers explain to their prospects that they don't just take a piece of the pie,” Pound says. “Really good property managers actually expand the pie. They get more money for the property either by being able to charge more through marketing or reduce vacancy and turnover – and therefore, they're able to actually reduce all the losses that you would have from a rental property.”

In the end, you can focus on each of those separate types of prospects and build campaigns that speak directly to them.

6. Track the numbers and optimize: Unit Acquisition Cost & ACV

To optimize your acquisitions, it’s key to understand your numbers. That’s obvious, but how do you do it, and what are the most important numbers to track?

Pound points to unit acquisition costs (UAC), customer lifetime value, and annual contract value (ACV).

“We have monthly recurring revenue for months and months, if not years and years,” Pound says. “So you have to understand some of these numbers.”

- Unit Acquisition Costs (UAC): “How much does it cost you to acquire a door?”

- Annual Contract Value (ACV): “How much does each customer bring me annually?”

- Customer Lifetime Value (CLV): “How much does each customer bring me over their entire lifecycle as my client?”

Pound breaks down how CLV affects your judgment on UAC. If a customer stays with you for five years and you're making $200 a month, their lifetime value is going to be $12,000.

“You start to understand that you're willing to invest a little bit more than you thought to acquire that customer,” Pound says.

This brings us to….

7. Build the list and lower your costs

You want to be always building your list of potential clients and client referrals.

“Think about that buyer's pyramid,” Pound says. “Think about attracting and courting those people that are lower in the pyramid before they're ready to buy. We can actually acquire those people for pennies on the dollar versus the really high expense of going after Google pay-per-click or buying leads.”

“Let’s say one day, a major life or business event will happen that will turn a prospect into a buyer today. Instead of having to go to Google to look for you, where you have to spend $17 per click, they already look to you for advice and help because you’ve courted them over time. When the life or business event happens, they’re ready to buy from us.”

8. Sweat equity or check equity

It takes investment to create clients. In the end, Pound says, that investment decision comes down to: “sweat equity or check equity.”

- Sweat equity = time spent

- Check equity = money spent

“Some entrepreneurs and business owners have more time than money, and they're going to want to spend money on advertising that works,” Pound says. “On the other hand, some entrepreneurs or property management owners have more time than money, and they're going to want to invest their time.”

Sweat equity could look like:

- Networking with referral partners

- Direct outreach (outbound) to investors

- Calling FSBOs

- Partnerships

- Facebook Groups

- Forums

- Hosting events or going where the investors are

- Social Media (LinkedIn, Twitter, YouTube, FB, Bigger Pockets)

- Organic online marketing

- Search Engine Optimization (SEO)

- Webinars

Check equity could look like:

- Direct mail

- Digital marketing (Google ads/PPC, YouTube, LinkedIn, Bigger Pockets, FB)

- Radio and TV

- Pay-per-lead

- Outdoor

- Hosting premium events with recognized speakers

Final Thoughts

In the end, getting qualified leads and new business is all about targeting and positioning. As Pound says, “The punchline at the end of the day is: If you’re going to spend money and time, you might as well be positioned. You might as well have the right language – the dog whistle – so you can get more out of every ounce of your sweat equity or every penny of your check equity.”

For more insights from leaders like Jeremy, check out our Triple Win Podcast for residential property managers. Or, here are a few places to keep reading about growing your PMC: