Indoor growing can be fast, easy, and fun with a DIY hydroponics setup.

Last month, we gave you the ins and outs of how to start your own vegetable garden. Now, with summer heat in full swing, toiling in that summer heat can be exhausting. So why not move the garden inside?

Move the garden inside? That sounds like a lot of dirt on the floor.

Actually, there is no dirt involved at all!

No soil in the garden? Do . . . do you not know how gardens work?

Of course we do. We're talking about hydroponics.

Ahhhhh yes, hydroponics. What's hydroponics?

Merriam-Webster's dictionary officially defines hydroponics as "the growing of plants in nutrient solutions with or without an inert medium (such as soil) to provide mechanical support." In layman's terms, it's the process of feeding plants the nutrients they need with a water-based solution instead of naturally through the soil.

Advantages of growing hydroponics

- A plant growing in a hydroponic system can grow around 30% faster than a plant grown in traditional soil. This happens because the plant does not need to expend energy in search of nutrients within the soil continuously. Instead, the nutrients are carried right to the plant, and that energy goes to growth.

- A hydroponic system can use as much as 95% less water than traditional soil-based growing methods. Since the system is enclosed, water used in the growing process is not exposed to the outside world, which reduces evaporation.

- Environmental conditions don't play a large role in the success of your crop. Since your plants are growing inside, factors like weather conditions and soil type won't impact the growth of your crops. You have a lot more control over the growing conditions.

Disadvantages of growing hydroponics

- Hydroponics can be an expensive hobby. There are lots of different types of hydroponic systems (we'll get into those later), but top-end systems can cost more than $500 alone. Fortunately, there are more affordable DIY options.

- In traditional gardening, the soil stores nutrients that the plants can access on their own. In hydroponics, there is no nutrient storage. That means you're feeding the plants directly. If something breaks in your system or you forget, your plants will end up just like your Digipet.

As long as you can ensure that your plants will receive the appropriate amounts of nutrients and light, you can set up a hydroponics system pretty much anywhere, including in the comfort of your own home. Pre-constructed systems are available for purchase online, which can become quite expensive, or you can have some fun and make your own. The choice is yours.

Before we start though, here are a couple of terms you should know.

- Growth tray - Where the plants themselves will sit

- Reservoir - The bucket or tank that will hold the nutrient solution

- Nutrient solution - A mix of water and key nutrients plants need to grow and will be supplied to the plant roots

- Growing medium - the material that the plant will lay roots in (not present in every system)

Related: What is the resident benefits package?

How do you build your own system?

Building your own hydroponics system can be as simple or as complex as you would like. There are some really simple types of systems that require little effort to set up, and there are some really serious investments you can make. Deciding what kind of system is right for you is the first step. Since we're betting against most of you wanting to build a $5,000 hydroponics wonderland—because who has time for that?—we're going to focus on the smaller-scale systems that are best for building in your home.

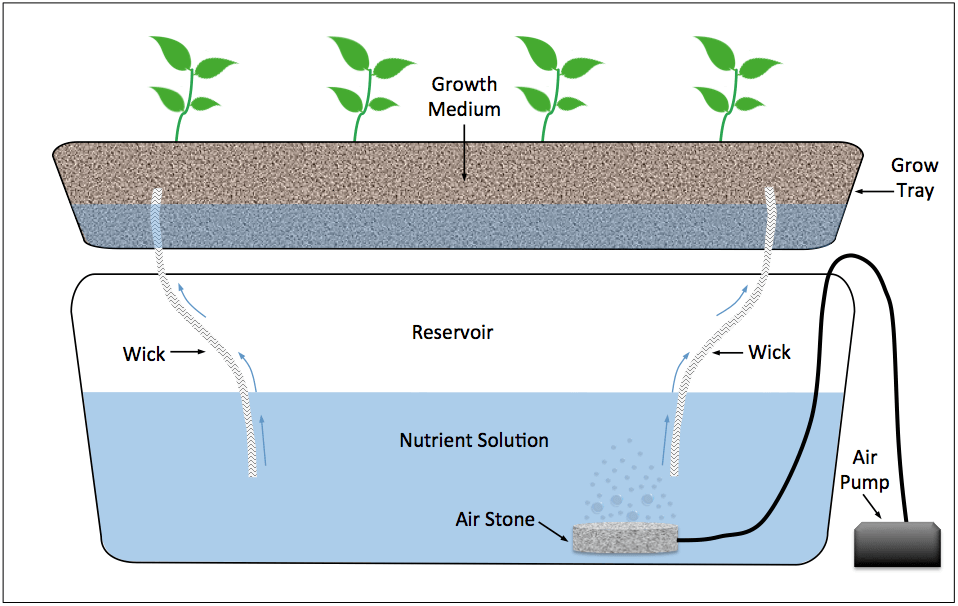

Wicking systems

A wicking system is the most basic hydroponic system around and it's great for getting started in hydroponics. It has been called the "training wheels of the hydroponic world" and for good reason. It's easy to set up and use, making it the perfect system for first-timers.

This system has seen some innovation, but the general concept is older than hydroponics itself. All you'll need are two containers, your plant of choice, a growing medium, and a wick (hence wicking).

SN Tip: Growing medium is inert, which means it won't decay, and it provides no nutritional value to the plant. It exists to provide structural support, and that's about it. Common mediums include things like vermiculite or perlite, but just about anything that will give the plant support and allow it to root can function as a growth medium. Sand is another example.

This wick does not have to be anything particularly specific. A piece of rope or string will work fine. You set up the system so that the reservoir sits below the growth tray. You then run your wick or string from the solution in the bottom container up into the growing medium in the growth tray, as pictured.

SN Tip: The reservoir and growth tray can really be anything. As long as it can hold a solution, it should work. On a small scale, you can use bottles. Large plastic tubs will also work.

Fill the bottom container with the solution and the top with the growing medium and plants and you're done. Capillary action will move the nutrient solution up the wick and into the growth tray with consistency that will allow the plants to intake the nutrients and grow.

SN Tip: Capillary action has a very sciencey definition, but all you need to know is that it's the movement of water or another liquid across a surface against gravity. The physical properties of water make this possible and it's what allows a wicking system to work.

SN Tip: fill the bottom reservoir as much as possible in order to minimize the distance the solution has to travel.

The advantage of the wicking system is that it's super easy to set up and maintain. The disadvantage is that it won't supply nutrients to the plants at the same rate as some of the more complex systems, so the variety of plants that can be grown in a wicking system is a little smaller. Plants that don't "drink" as much, such as smaller plants like lettuce or different types of herbs, grow best in a wicking system.

SN Tip: Wicking systems also don't require the use of a water pump to deliver the solution to the plant roots, making it a "passive system." Those that do require a pump to move the solution to the plants are referred to as "active systems."

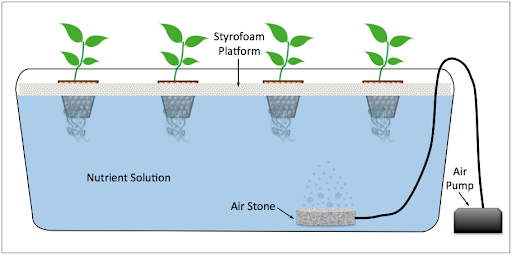

Deep Water Culture (DWC) systems

A DWC system is a little bigger and a little more complex than a wicking system, but all in all, it's still relatively simple. This system differs from a wicking system in that it submerges your plant's roots in solution 24/7 instead of a growing medium that is supplemented by the nutrient solution.

Image: offgrid.com

Because of this, it is critical that the aquatic environment the plants live in is properly managed. pH and oxygen level management are quite important with the DWC. An oxygen pump is necessary to ensure that oxygen levels remain sufficient.

Setting up a DWC only requires one reservoir and does not need a growth tray. The reservoir is filled with a nutrient solution, and the air pump is installed to ensure the appropriate amount of dissolved oxygen.

SN Tip: Smaller DWCs are harder to manage because it's challenging to keep nutrient concentration, dissolved oxygen, and especially pH levels consistent.

The plants themselves are suspended above or on top of the liquid solution in net pots. Net pots are simply pots with holes in them that allow roots to sit underneath the pot and submerged in the solution. There are several different ways to install the net pots in a DWC system. You can float them, where you attach a flotation device to each pot and allow them to rest on top of the solution. The second option is to suspend your plants in the air above using a brace or a roof with holes in it. The actual process of doing this depends on how you construct your reservoir, but the image below will show you a good example.

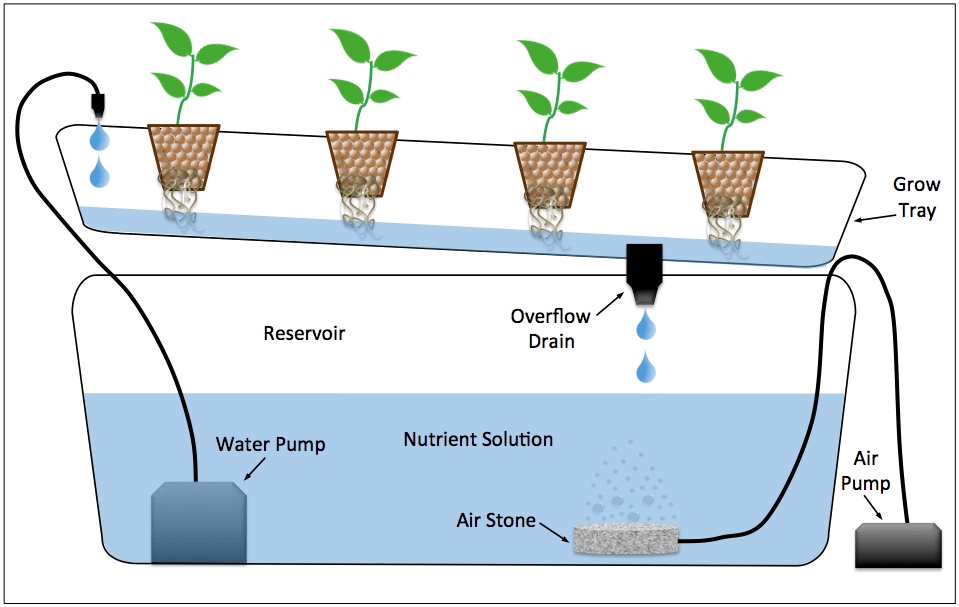

Nutrient Film Technique (NFT) systems

An NFT system is among the most popular hydroponic systems. It's an active system that requires a water pump to run, but other than that it is set up very similarly to a wicking system.

Image: offgrid.com

Like the wicking system, an NFT has both a reservoir and a growth tray. Unlike the wicking system, a pump is used to move the solution from the lower reservoirs to the growth trays (or upper reservoirs), where it flows across the tray and drips back into the lower one. The system also requires an air pump to ensure the water is properly oxygenated.

NFT, like any active system, requires a little more maintenance because the water does not reach the plants naturally. You're dependent on your pumps to keep the plants receiving the nutrient solution. If a pump goes out, your entire garden is at risk. Thankfully, this isn't common (pump technology isn't particularly complex), but it is something to stay aware of.

Other systems

An ebb and flow system and a drip system are similar to NFT systems, with the lone difference being how the solution is supplied to the plant. An ebb and flow system uses a pump to flood the growth tray the plants reside in periodically, draining it shortly thereafter. It's like an NFT except it doesn't push the solution through continuously. A drip system is also similar to an NFT, but instead of filling the upper reservoir with nutrient solution, the solution is trickled from drip lines on top of the plants in the growth tray, where it then percolates through a growth medium and falls back into the reservoir.

SN Tip: Because of the recirculation of these systems, pH and nutrient amounts can change frequently, so consistent monitoring is recommended.

How do I manage pH?

pH is an absolutely critical element of a functioning hydroponics system. A pH level that is all out of whack can cause plants to die from insufficient nutrient uptake or, believe it or not, too much nutrient uptake.

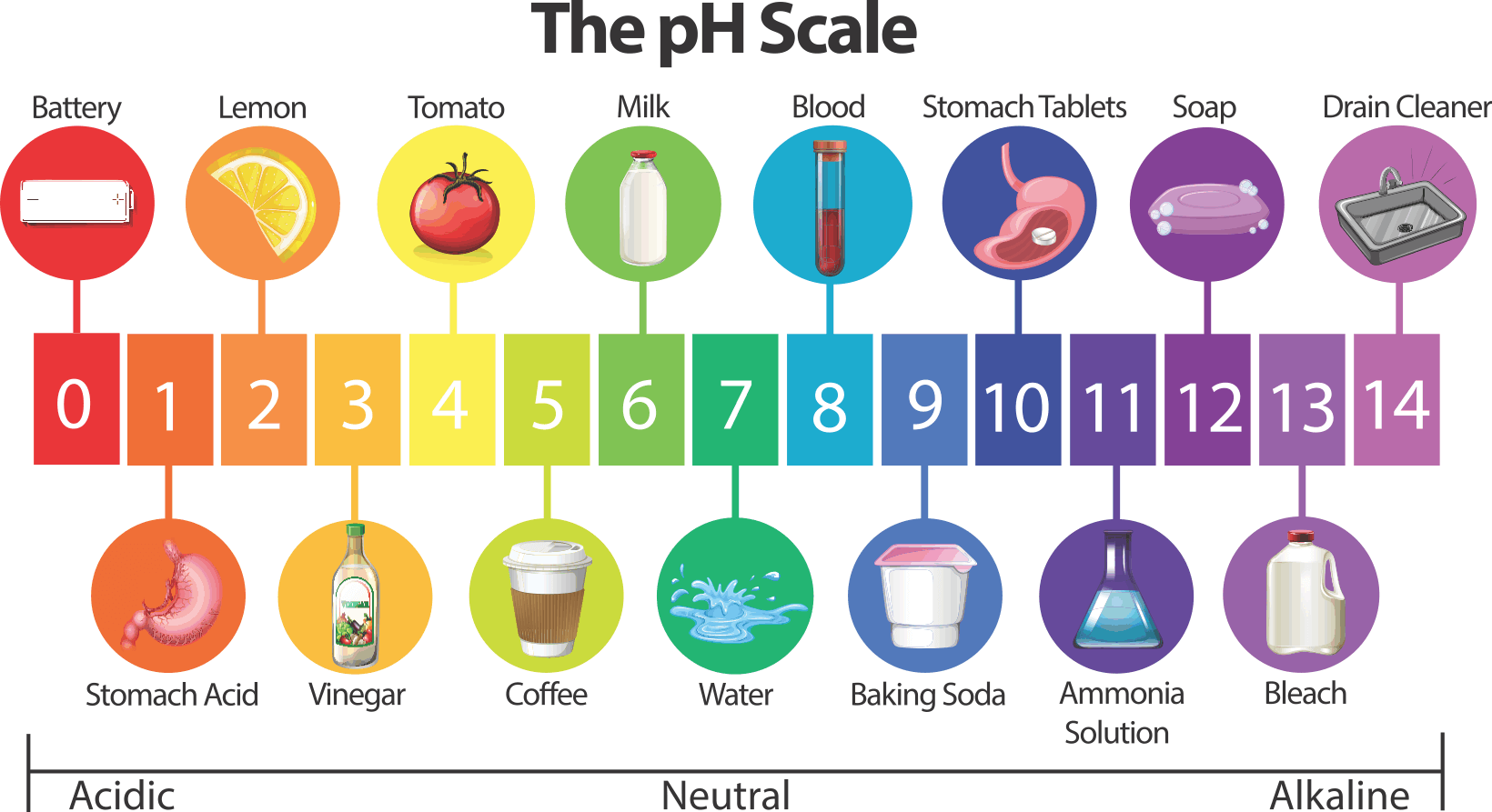

For anyone who didn't pay attention in eighth-grade science class, pH is a measure of the acidity of a liquid. The scale runs from 0–14, with lower numbers being more acidic and higher numbers being more basic. For reference, battery acid has a pH of 0, water has a pH of 7, and drain cleaner has a pH of 14.

The reason this is so critical is that the solubility of nutrients changes at different pH levels, which affects the ability of the plant to absorb these nutrients. If the plant has trouble absorbing nutrients from your solution, growth will be stunted, and the plant will eventually die. If levels are too high and the plant absorbs higher than acceptable amounts of nutrients, it can die from poisoning. You can have the coolest hydroponics setup in the world, but if your pH is off, all your plants will still die.

SN Tip: There are multiple ways to test your pH. The easiest and cheapest are pH test strips, which are extremely quick and easy to use and available at any gardening or pet store. You simply dip the strip in the solution, swish it around for a manufacturer-specified amount of time, and then match the color it turns to the color on a corresponding table that comes with the test strips.

As you'll see below, many plants prefer a slightly acidic nutrient solution. It's necessary to continually test your solution to ensure it remains at the right pH. If you find it needs adjusting, you have a few options. The easiest is adding "pH up" or "pH down" chemical solutions. These are readily available at the store or online. Follow the manufacturer's instructions for how much to add and be sure to check your pH frequently.

What can you grow in a hydroponics system?

You can grow just about any type of fruit, vegetable, flower, or herb. Ideal growing conditions will vary by plant, and some are more suited for specific system types because of it, but almost anything can be grown with hydroponics.

Hydroponic lettuce and hydroponic tomatoes are some of the more common items to "plant" in your system. Lettuce, in particular, is one of the best plants for beginners looking to dive into the world of hydroponics. The leafy green is easy to grow, will grow in a wicking system, and can be harvested in just one short month.

Fruits like strawberries and the aforementioned tomatoes (a tomato is a fruit, deal with it) have a slightly longer grow time, but are good starter crops as well. Below you'll find some popular plants and key details needed to succeed at growing them.

Lettuce

- pH range: 6.0-7.0

- Grow time: 1 month

- Difficulty: Easy

Tomatoes

- pH range: 5.5-6.5

- Grow time: 2 months

- Difficulty: Easy

Strawberries

- pH range: 5.5-6.5

- Grow time: 2 months

- Difficulty: Easy

Spinach

- pH range: 6.0-7.0

- Grow time: 1.5 months

- Difficulty: Easy

Bell peppers

- pH range: 5.5-6.5

- Growth time: 3 months

- Difficulty: Easy

Hydroponics is a fun way to grow your own fruits and vegetables from the comfort of your own home. It can get complex and expensive, but it doesn't have to be if you don't want it to be. Simple and easy systems exist that will allow you to enjoy fresh homegrown produce at your dinner table.

You know what else you can make simple and easy in your home? Air filters, with Second Nature. Never forget to change your filter again.

Topics: