Thanks to ragweed pollen, fall allergies can be a pain when you're trying to enjoy the changing weather. Prepare for ragweed below.

Pollen sucks. Its existence is essential to life itself, but it’s an absolute menace to allergy-afflicted individuals throughout the spring . . . and the fall.

“Wait, and the fall?”

Yes, and the fall.

“That’s like half the seasons. I didn’t sign up for that.”

Well, the summer as well. That’s when grass pollen comes out.

“. . .“

“So if spring is tree pollen and summer is grass pollen, what is fall pollen? Bush pollen?”

Ragweed, mostly. Ragweed pollen is public enemy number one in the fall for allergy sufferers.

The good news is that you aren’t allergic to all pollen because you are allergic to one type of pollen. Just because tree pollen, the yellow dust that coats entire cities in the spring, causes you to sneeze and itch, doesn’t necessarily mean ragweed pollen is going to do the same.

Tree pollen in the early months of the year is generally a more prominent allergen. That’s why springtime gets the most hubbub when talking about allergies. Despite this, a larger number of Americans actually suffer from a fall pollen allergy than a spring one.

So, what is ragweed and what does it look like? Keep reading to learn all about this sneaky irritant that may result in an unsuspecting ragweed pollen allergy.

What is ragweed & what does it look like?

What does ragweed look like? It’s a flowering plant that looks about like this:

Ragweed can be found growing in fields, on roadsides, or anywhere there is open space in every state excluding Alaska (do you think Alaska feels sad for always being excluded?). There are lots of different species of ragweed, such as sage, eupatorium, and just in case ragweed wasn’t a gross enough name for you, there is also mugwort.

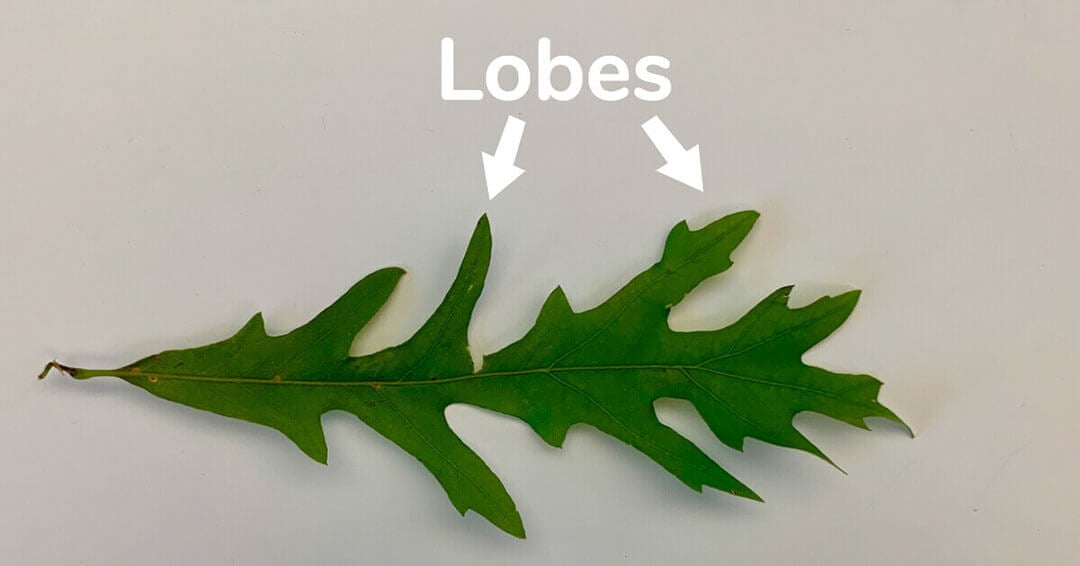

The two primary offenders in the case of allergen production are the cleverly named common ragweed and giant ragweed. These species of ragweed can be identified by their lobed leaves, which other species don’t have. Lobed leaves look like this:

The difference between giant ragweed and common ragweed is that giant ragweed is bigger. You’re welcome.

Ragweed vs. Goldenrod

Goldenrod is a very similar looking plant that, like ragweed, can be found just about anywhere in the United States. Genetically, it’s extremely different from ragweed, and its pollen is not an allergen. Nobody in the country is allergic to Goldenrod pollen. People often confuse it with the allergy factory of ragweed because of their similar appearances, and also probably because it's bright yellow and that is the color people associate with pollen. It is harmless though. Below is a side-by-side comparison so you can tell the difference.

When is ragweed season?

Like tree pollen season, ragweed pollen season can vary slightly by geographic location. It usually starts a little earlier and ends a little earlier the farther north you travel. While the plant can begin flowering as early as July, August is typically the month when ragweed pollen begins to infect the air around us. So, if you have a ragweed pollen allergy, you’ll likely notice symptoms at the end of summer through the start of winter. Late October is when it starts to diminish in the northern states, and it survives until late fall, usually mid-November, in the southern states. The first significant frost often coincides with the end of ragweed’s pollination time. So root for an early frost if you’re a ragweed pollen allergy sufferer.

How is ragweed pollen different from tree pollen?

It’s not, really. There are a few minor characteristics that are different, such as oak tree pollen being able to remain suspended in the air longer than ragweed. Ragweed produces a lot fewer individual pollen grains per plant. Overall, it’s a slightly less potent allergen than oak pollen and other tree pollens in the spring, but still pretty obnoxious if you’re afflicted with an intolerance. It also doesn’t cover the ground in a thick yellow dust, making it a less common talking point in the world of pollen allergies because of the lack of visual presence. Just like tree pollen though, it still sucks.

How do you manage a ragweed pollen allergy?

So, you know what ragweed looks like. But what do you do if you find you have a ragweed pollen allergy? Here are three tips to keep your symptoms at bay.

Pay attention to weather forecasts

There are a couple of reasons to keep an eye on the weather for today and the coming days. The first is pollen counts. You can also check these online at a place like pollen.com. We talked at length about these in our spring pollen blog, so we won’t dive too deep here.

Pollen counts, or pollen index, can vary based on many weather factors though, so some days outside will be way worse than others. The forecasts take these into account to give you an accurate idea of how prevalent the allergy threat will be each day.

Generally speaking, the mid-day hours are the worst for ragweed pollen. Going for that run or bike ride at dawn or dusk is a good idea if you have a fall pollen allergy (this is a good idea anyways in August, as it’s the hottest month of the year in many places). The wind is also responsible for driving up pollen counts. A consistent breeze will push pollen grains into the air and stop them from settling. So avoid windy days for your outdoor activities.

Also, keep an eye on rain in the forecast. Rain is the best thing for a ragweed pollen allergy. It washes pollen out of the sky and washes away pollen on the ground that can be resuspended in the air. If you’ve got an outdoor activity planned this fall, see if you can schedule it for the day after a rain. You’ll be a lot happier and healthier spending time outside because of the sudden decrease in pollen counts.

Take medicine

When you’re buying medication for your allergies, there is not a lot that is different in the fall versus the spring. Antihistamines such as Zyrtec or Chlor-Trimeton block allergens by binding to receptors within the body, depriving the allergen of its chance to make you sneeze right before it succeeds.

Antihistamines are effective because they target the actual cause of the allergic reaction instead of treating the symptoms. Other medications specifically for symptoms, such as decongestants, are available if you happen to have an antihistamine intolerance.

Keep ragweed pollen outside

If you’re a serious pollen allergy sufferer, it’s important to cover your bases when it comes to the air inside your home. You can’t rid the outside air of ragweed pollen, but you can keep it from getting inside.

Keep your windows and doors closed, especially on windy days. It may be tempting to leave your front door open or crack a window when that cool fall weather begins to roll in, but that’s the only barrier between your house and ragweed pollen.

Remember that pollen can also be carried into your home on your clothes, body, or pets.

- Change clothes after spending a significant amount of time outside and drop those clothes in the washing machine.

- Shower after significant outdoor activities.

- Wash your hands after petting any dogs or cats that have been outside.

If it gets inside, don’t fret. Simply follow our best practices for how to remove allergies from your home.

Close the top on your convertible this time of year too.

Filter ragweed pollen out by keeping clean air filters in

You can make a material difference in the amount of ragweed pollen that enters your home by taking those simple precautions. You can’t eliminate it entirely, though. One of the best ways to keep your home as pollen-free as possible is to use air filters with high MERV ratings (8 or above).

Using a high-quality air filter, like Second Nature’s Health Shield or Essential+ filter, will pull those sneaky particles out of your home and into the garbage. Get one today.

Not sure what size to get? Learn about air filter sizes and how they work to remove allergens from your home.

Topics: