The property management industry is full of entrepreneurs – self-reliant self-starters who got in the game as a side hustle and grew their property management company to be a full-time occupation. But, of course, with growth comes the need to hire a team. And the key to successful team-building? An optimized property management org chart.

An organizational chart is a visual representation of a company's structure, showing the roles and relationships between different positions within the organization. Property management companies are no exception, and getting your property management company structure right from the beginning has a massive impact on the quality of experience of your investors, employees, and residents.

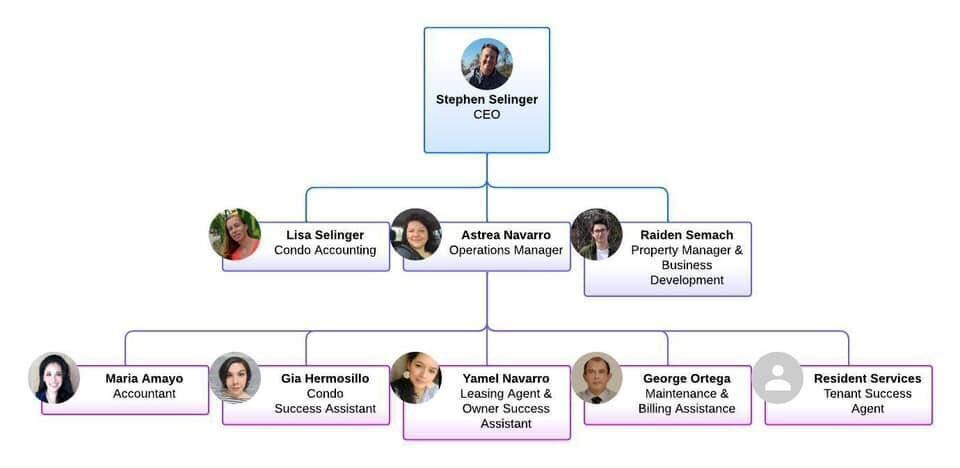

Example of a property management org chart with 500 rental units

Example of a property management org chart with 500 rental units

In this article, we’re exploring the benefits of having a clear and concise property management company org chart with the help of Kelli Segretto, Founder of K Segretto Consulting. Kelli has helped with the launch of hundreds of property management companies and has tons of insight into how a PMC should be structured for success.

Key Learning Objectives:

- What does an ideal property management organizational chart look like?

- How should you structure your property management company?

- What’s the difference between an org chart for a PMC vs. a real estate agency?

- How can you use your org chart to align employee roles?

- Who should you hire first?

- What’s the most important role in a property management company?

- What are the most common mistakes made in structuring a PMC?

Meet the Expert: Kelli Segretto, Founder of K Segretto Consulting

Kelli is a sought-after speaker and consultant with over 20 years of experience in the property management industry. Kelli has expertise in single-family, multifamily, and LIHTC property management, having coached across all 50 states and six countries. She has helped launch hundreds of new property management businesses and has developed in-depth knowledge of the types of organizational structures that work best in property management.

Example Property Management Org Chart

We asked Segretto about the primary areas of responsibility – or key roles – that that are essential to a successful property management business. She outlined six key focus areas regardless of how you end up structuring the company:

- Operations Management

- Property Management

- Leasing

- Maintenance

- Bookkeeping

- Sales

According to Segretto: “Different structures will dictate the position titles and responsibilities within these roles, but these are the foundational pillars each property management business needs.”

To get started with the cascading structure of the org chart, Segretto explains that in a full property management company structure, you typically see three-deep leadership: owner/broker, manager, and coordinator, each with their own focus area from the list above.

“Even if your business is small, it is important to have an organization chart to plan for your future growth,” Segretto says.

Here’s how it might break down in your PMC.

Tier 1: Owner/Broker

The Owner/Broker is the executive leadership or highest role and tier in the org chart.

“In most states, you cannot operate a property management company without a licensed broker,” Segretto says. “The requirements to obtain your principal broker license varies by state, but most require a combination of time as a real estate sales agent, experience points, and education.”

Of course, the owner of the PMC isn’t always the broker, depending on various circumstances or state laws.

“A person with a broker’s license can sign on to be the broker of record or broker in charge for a property management business,” Segretto explains. “We see this when the business owner cannot yet meet the qualifications for their broker license, for example, in franchise property management companies and other organizations that are coming into property management from outside the industry.”

Anyone newer to the industry should take note, says Segretto, “This arrangement can be tricky in some states, like New Jersey where you must operate under the same roof as your broker, or Ohio where any brokerages active under a broker must have the same core company name. There are many state and local regulations you have to be aware of when opening a property management company. My recommendation is always to reach out to your local department of real estate for guidance and information or work with a consultant that specializes in property management business startup.”

Related: Property Management Startup Checklist

Tier 2: Management (Operations, Sales, Finance, Maintenance, and Leasing)

Reporting directly to the owner (who is usually also the broker) is a set of management roles. Depending on the size of your company, this may be one or many individuals, depending on the expertise and skills gaps of the owner.

Your management level typically includes roles for Operations, Sales, Finance, Maintenance, and/or Leasing. These individuals have a fairly high level of responsibility overseeing their area and any direct reports under them.

Related: Best Property Management Maintenance Software

Tier 3: Coordinators (Property Management, Maintenance, Leasing, and Bookkeeping)

Reporting to the management roles are employees at a coordinator level. You may hire coordinators that focus on property management, maintenance, leasing, and bookkeeping. These roles will fall under the purview of the manager above them.

Tier 4: Assistants

In large organizations, you may also see assistant roles that support the coordinator or management roles.

For each of these tiers of responsibility, Segretto says, “the titles and function will vary depending on the type of structure you are operating under, but the core organizational buckets remain the same. In a small property management business, it isn’t uncommon for the first roles to be 1099. This helps keep costs down for the property management company as long as they are not treating their 1099 partners like employees. For example, scheduling their time, requiring uniforms, etc. As a property management business grows and stabilizes, most of the roles in the business become employees.”

(Segretto provides her clients with several org chart templates that walk through the different roles and responsibilities in each configuration.)

Types of Property Management Company Structures

“Each property management business is unique,” Segretto says. “Some businesses service savvy investor clients, some focus on small multifamily, some are only high-end luxury while others have found their niche in Class C rentals. This means that the best property management business structure can vary for your organization.”

Segretto explains that the ideal organizational structure for your business is the one that provides the best user experience for your clients, assigns ownership to the essential tasks, and keeps everyone on the same page.

“Too often, I see businesses that have everyone trying to do everything, which ultimately creates chaos and confusion,” Segretto says. “Phone calls don’t get answered, emails get lost, and everyone expects someone else has ‘got it.’”

Instead of this chaotic approach, Segretto recommends choosing from three common property management company structures: Portfolio Management, Departmentalized, and Process Driven.

“Determining which one is best for your office is dependent on your location, your staffing capabilities, your goals, and your budget,” Segretto says.

Here’s how they each work

Portfolio Management Structure

The portfolio management structure typically involves assigning a dedicated property manager to oversee a set of client accounts. That PM is responsible for all aspects of the portfolio, including property maintenance, resident relations, leasing and marketing, financial management, and other activities related to the management of the real estate assets.

The manager is typically supported by a team of administrative and support staff, including accounting and financial specialists, leasing agents, property managers, project management specialists, maintenance technicians, and other professionals who work together to ensure the successful management of the real estate assets.

Overall, a portfolio management structure gives clients a premium experience with one point of contact and allows for nimble decision-making. On the downside, portfolio management requires employees to have strong cross-skills, opens the PMC up to risk if that property manager leaves or goes on vacation, and makes it difficult to create operational consistency between portfolios.

Related: Best Property Management Podcasts

Departmentalized Structure

Department-style management organizes the PMC into separate functional categories, grouping employees and teams based on their roles and responsibilities. You might see departments such as accounting and finance, leasing and marketing, property maintenance, resident relations, and other functional areas.

Each department is headed by a department manager who would oversee the day-to-day operations and staff within that department.

The benefit of a departmental structure is specialization over generalization. Employees are experts in their field and can focus on improving their area’s performance. The downside is that clients and residents may have multiple points of contact, and communication may get repetitive. No single person is keeping an eye on a specific property’s overall performance.

Process Driven or “Pod” Structure

A pod-style management structure in PMCs is a relatively new management concept that organizes employees into small, cross-functional teams called "pods.” Each pod is responsible for managing a specific portfolio of properties or assets within the company and typically consists of a portfolio manager, a leasing agent, a maintenance technician, and an administrative staff member.

The pod-style management structure is designed to bring the benefits of the portfolio and departmentalized structures together – but can also suffer from their weaknesses. Pod-style management encourages collaboration and communication among team members and gives residents and clients an excellent customer experience. The structure also allows for greater flexibility and agility, as the pods can adapt quickly to changing market conditions and resident needs.

Pod-style management is ideal for a fast-paced, dynamic environment where rapid response times and a high level of customer service are essential. By working in small, self-managed teams, pod-style management can lead to greater efficiency, productivity, and innovation while also improving employee satisfaction and engagement.

The downside is that the pod structure can be expensive until you fully scale up.

What is the difference between the structure of a PMC and a real estate agency?

We asked Segretto to explain how a PMC org chart differs from that of a real estate agency.

Segretto explains: “I had a client that structured their business like a real estate office, and it worked really well for them when they were small. As they started to grow and scale the business, it became limiting. Real estate offices have a very simple structure. Typically you have an owner/broker, and in larger offices, back office services like marketing, bookkeeping, office assistants, and maybe a transaction department. These are support services made available to the sales agents. Sales agents are independent business owners, often with their own LLCs. They are not employees of the company.”

She also points out that some companies operate as both a real estate business and a property management company. “In these businesses, you may have a blend of the two org charts. You will still need all the same buckets as a property management business, but often those roles take on double duty to support the sales agents who still remain independent contractors.”

FAQ: How to Use Org Chart to Align Employee Roles and Make the Right Hires

So, let’s say you have an idea of the property management company structure you want and the types of roles you need. How do you actually get started? How do you make your first hires or align your current employee roles with your planned ideal structure?

We asked Segretto some of the most frequently asked questions on this in the property management space. Here’s how she answered.

What should I focus on in the hiring process?

Segretto: Property management is an industry that can be trained, but human behavior is much harder to adjust. Pick the right personalities and drive for your team rather than the person with the most experience on paper.

That doesn’t mean you should pick the person you get along with best or you think you could be friends with. It is important to identify the key personality traits that will be most beneficial in each role. Remember, your employees will be the face of your company. They will be the ones delivering on the promises you make each client.

Make sure you have written job descriptions and a deep understanding of the role the person would fill. Setting proper expectations will also aid in finding the right person who will enjoy the work they are hired to do.

In the interview process, ask qualifying questions and provide scenarios to see how the individual problem solves. This industry is fast-paced, multifaceted, and complex. It isn’t for everyone.

Most of all, be patient. Start hiring before you need to so you don’t feel pressured to pick someone fast rather than ensuring you have the right person in the right seat. Take your time and avoid costly mistakes.

Who should I hire first?

Segretto: I have had the opportunity to help launch hundreds of brand-new property management businesses in my career, and one of the most common questions is, “Who should I hire first?”

Initially, a property management company is typically run by a sole operator. The business owner wears all of the hats. It is beneficial for the owner to go through this phase of start-up as they learn all the ins and outs of the business and discover their strengths and weaknesses.

I like to then take my clients through an exercise where we can discover the highest and best use of their skillset and time. From that exercise, you can then determine what role would be your ideal first hire. For many people, this is a business development manager to cover sales or a back office employee, like a bookkeeper.

What are the key components of management structure in a PMC?

The key components of management structure are customer experience ownership, work specialization, organization, coordination between departments, and continuous training.

Property management is a customer service business. The structure you create should focus on the components that will foster internal communication, collaboration, and a culture of learning.

What is the most important role in a property management company?

Segretto: This is a tricky question! It reminds me of the grade school phrase, “There is no ‘i’ in Team.” Property management is a team sport; there is no one role that is most important or featured in the line-up.

Your team will only be as strong as your weakest link, which is why it’s so important to hire talented individuals with the right personality and drive for each role. Once you have your superstar lineup, it’s crucial that you treat them well, trust them, and listen to the valuable feedback and insights they have. It’s more about having the right person in each role than it is about one role being valued higher.

What are the most common mistakes you see in a PMC organization structure?

Segretto: The two most common issues I see in the property management structure are:

- Too many points of contact for property owners and residents to keep track of. Keep it simple! Assign a point of contact to every relationship, and if that point of contact needs to shift, arrange a proper handoff. This business is built on trust, and as humans, we inherently don’t trust strangers.

- Lack of communication between departments. This business is built on a foundation of excellent customer service. It’s critical that you have processes in place that keep everyone in the loop. Most processes require multiple team members' effort, and when communication breaks down, the card house collapses.

Final Thoughts

Segretto recommends hiring a consultant to help you develop your org chart for both today and your future growth plans.

A good org chart should include “job descriptions, KPIs, and personality traits for each role within your chosen structure,” Segretto says. “A consultant can take you through a process to identify your core values, goals, and action plan, which will help set a solid foundation for your business.”

Learn more about property management structures, growth, marketing, and more in our Second Nature Community, or get in touch with Segretto via her website.

Topics: