11 Best Property Management Websites: Design Examples and Key Features

Your property management website competes against thousands of similar sites for owner and resident attention. The best PM websites don't just list services—they communicate specific value through design choices, content strategy, and user experience. These 11 examples show different approaches to standing out, from video-first content to investor-focused messaging to resident-centric branding. TL;DR: Great property management websites balance two audiences: property owners seeking reliable investment returns and residents wanting responsive service. This review covers 11 top PM websites, including Second Nature's resident-focused approach, Chambers Theory's video content strategy, and Bay Management Group's investor-first design. Each real estate website example shows different ways to communicate value through design, content, and functionality. Use these as inspiration for your own site improvements. Website Primary audience Standout features Second Nature Single-family property managers Podcast, blog, and newsletter original research reports; templates, checklists, and guides Chambers Theory Commercial and residential property managers and residents in the greater DC area High-quality video content; clear navigation; multi-language support Nest DC Scattered-site property investors and residents in Washington, D.C. Differentiation of resident and owner portals; strong branding; clear service offerings Bay Management Group Property investors and HOA boards in the Mid-Atlantic region Blog; property management analysis offering; clear branding Rentberry Self-managing investors and prospective residents Simple toggle between residents and investors; engaging visuals; value calculators Grace Property Management and Real Estate Commercial and residential property investors and residents in Denver Clear rental analysis offering; video library; value calculators MESA Properties Single-family property owners and residents in Southern California Home page videos; clear navigation between real estate and property management; clear geographic coverage Golden State Property Management Residents and investors in the South Bay Area of California Mobile-first design; clear calls to action; affiliation listings to build trust Sleep Sound Property Management Property investors in Portland, OR Clear differentiation messaging; social proof Good Life Property Management San Diego property investors Resident review videos; landlord newsletter Luxury Property Care Real estate investors in South Florida Passive income messaging; SEO-friendly FAQ section What makes a great property management website Building a great property management website is part art and part science. In order to capture the right audience and convert them to customers, there are a few key elements your site needs to have. Clear value proposition As soon as someone lands on your website, they should immediately be able to understand what you offer. This is where you should lean into your differentiators. What do you offer that your competitors don't? You should also highlight the types of properties you manage, the services you offer, and the geography you cover in a concise, succinct way. Be clear about who is—and isn't—right for you. Mobile responsiveness It's 2026. Roughly 60% of all web traffic now comes from mobile devices. If your site doesn't work just as well on a phone or tablet as it does on a desktop, you're costing yourself in a big way. This is especially true for resident-facing content, since more and more applicants and residents are searching for their next home, applying, and paying rent via a mobile device. Most out-of-the-box websites have mobile responsive designs included by default, but you should still frequently test out your site on your own devices. Do images scale correctly? Are buttons large enough to click on? Is the overall user experience easy and smooth? Have different members of your team check the site and point out any issues. Portal functionality Make sure that it's easy for residents to pay rent, submit maintenance requests, and more right from your site. A clear login button and logical user flow will help keep residents happy. Most property accounting software providers offer integrated resident portals that you can link to directly from your site. If you also offer a real estate investor portal, make sure to include that on your site, too. It's crucial to make it clear which portal is for which audience so that users don't get confused or end up in the wrong place. Content strategy It's important to develop a cohesive content strategy for your website, and then be consistent with it. Your primary goal is to make sure that you're publishing content that directly appeals to your target audience and answers their questions. You can do some quick keyword research to identifying what kinds of things your audience is searching for, and then write content to address those topics. Focus on one topic per post and write with an honest, sincere voice. Don't try to sell your services on every blog post, and don't make up facts or figures, customer quotes, or anything else. Genuine content wins every time. Dual-audience approach The best property management websites address two key audiences: property owners and residents. This is a unique challenge because, in most industries, you have one key customer profile. In property management, you have two. Write content that appeals to both current residents and prospective applicants, who will come to your website to get questions answered, find homes to live in, and pay their monthly rent. At the same time, make sure you're also producing content for your current investor clients and those who don't work with you yet, but might be looking for management services. This is where you'll capture new business, so make this a priority. It might make sense to create two separate blogs; one for each audience. At the very least, you'll want to have clearly marked pages for each group so that they can easily navigate to the content that's most relevant to them. Make sure to consider all of these factors as you're choosing a website provider and building out your site. 1. Second Nature (secondnature.com) It may seem odd for us to mention ourselves first on this list, but we are genuinely proud of our brand and messaging! After all, we’re in this business for a reason – and that’s why the content on the Second Nature website is so squarely people-focused, with an emphasis on solutions that improve the lives of residents, investors, and property managers alike. There’s a robust business principle underpinning this “Triple Win” philosophy: residents want their needs proactively anticipated, and they're willing to pay (and stay) for that service. This is particularly true for a younger generation that is attuned to the convenience offered by services such as Uber and Amazon. That’s why the language used on our website reflects a human approach that goes beyond transactional basics, preferring “residents” rather than “renters,” for example, or “home” rather than “rental property.” It’s also why Second Nature’s “Resident Benefits Package” is front and center, and designed to give residents, investors, and property management businesses a win. Accordingly, like all successful marketing, Second Nature’s value proposition is not only tangible – it’s personal. Primary audience: Single-family property managers Standout features: Podcast, blog, and newsletter featuring expert property managers sharing their ideas; original research reports; templates, checklists, and guides for key property management activities 2. Chambers Theory (chamberstheory.com) Chambers Theory's company motto, "Real Estate with Intelligence" is evident across their entire website. They use their website to promote more than just vacancy listings. They actually aim to educate their prospective DC, Virginia, and Maryland residents and owners. Their content covers topics as broad as what property management is and as granular as garbage disposal care. But their real brilliance is in how they serve up this content. Instead of text, they've opted to engage with videos. They've professionally produced more than 160 YouTube videos that are embedded across their entire website. And they've even gone as far as reproducing some of them in 7 different languages, ensuring their relevance for their US Military, State Department, and Foreign Service clientele. Primary audience: Commercial and residential property managers and residents in the greater DC area Standout features: High-quality video content, clear navigation, and multi-language support 3. Nest DC (nest-dc.com) The Nest DC website focuses on the families behind the doors and the people behind the investment portfolios. Although residential real estate management is associated with a certain gravitas, the language and overall branding of the Nest DC website plays off of a certain “avian” riff and is designed for easy readability. It’s all done with serious intent, however, and the website design is sleek, clear, and user-friendly. Primary audience: Scattered-site property investors and residents in Washington, D.C. Standout features: Clear differentiation of resident and owner portals, strong branding, clearly outlined service offerings 4. Bay Management Group (baymgmtgroup.com) As soon as you hit the homepage of the Bay Management Group website, it’s clear that its primary target audience consists of real estate investors and property owners. That said, the site does host an impressive library of instructional and advisory videos for tenants, property managers, and landlords, as well as investors. With the tagline “property management that’s a cut above the rest,” home page testimonials, and a blue-toned web design of the sort favored by financial institutions to connote trustworthiness, the focus is on differentiation. Bay Management Group makes it clear that they deliver high-quality property management services and reliable rental income. Beyond its primary “free property management analysis” feature, other web functionalities include a blog, owner portal, tenant portal, and various program application options. Primary audience: Property investors and HOA boards in the Mid-Atlantic region Standout features: Blog; property management analysis offering; clear branding 5. Rentberry (rentberry.com) Rentberry is a global AI-powered rental platform that aims to connect residents and investors. With the tagline “Renting done right. Finally.” its principal focus is on prospective tenants and investors. Top-level navigation includes online rent payments/rent collection. It also includes tenant screening functionality as well as options to search listings for vacancies or create a property listing. Among the usual resources (blog, help center, FAQ, contact information), Rentberry also features pricing guides for both tenants and landlords to help streamline the onboarding process. Primary audience: Self-managing investors and prospective residents Standout features: Simple toggle between residents and investors; engaging visuals; value calculators Want insights delivered to your inbox? 6. Grace Property Management & Real Estate (rentgrace.com) Based in Denver, Colorado, Grace Property Management & Real Estate focuses on both residential and commercial properties in Denver. Although the company was founded in 1978, its online presence boasts astute use of online marketing tools and property management solutions. With numerous calculators and other resources available from the top-level menu, Grace's website provides value far beyond just property listings. The company makes their geographic focus clear right on the home page, and includes a clear login for residents and phone number for residents and investors alike. Primary audience: Commercial and residential property investors and residents in Denver, CO Standout features: Clear rental analysis offering; video library; value calculators 7. MESA Properties (mesaproperties.net) MESA Properties gives its geographical focus the hero image treatment, with the tagline “Serving the Inland Empire and High Desert.” The home page makes it clear that they're positioning themselves as both property management and real estate specialists. Also on the home page, an engaging video tells the company's story. Accordingly, much of the functionality on offer from the top-level navigation is focused on professional property manager services and resources for owners, but it does include resources for tenants, including maintenance request options, and portal login. Primary audience: Single-family property owners and residents in Southern California Standout features: Home page videos; clear navigation between real estate and property management; clear geographic coverage 8. Golden State Property Management (goldenstatepropertymanagement.com) The Golden State Property Management website leads with the tagline “Total property management of the most comfortable homes in the South Bay,” as well as a clear call to action for prospective residents to browse vacancies. With straightforward top-level menu options, mobile-friendly design, and high-contrast navigation elements, this site is exemplary in its simplicity. Primary audience: Residents and investors in the South Bay Area of California Standout features: mobile-first design; clear calls to action; affiliation listings to build trust 9. Sleep Sound Property Management (propertymanagementportlandor.com) Sleep Sound Property Management takes aim at the stress of managing the rental process, and as such takes on an advisory persona in its content. With the word “guarantee” appearing over 10 times on the homepage alone, the message is clear: this is a company devoted to providing great property management services in support of maximizing investment returns. Its “Why Choose Us” page also highlights its investments in cloud-based single family property management software, also designed to ease the stress of managing property investments. Primary audience: Property investors in Portland, OR Standout features: Clear differentiation messaging; social proof 10. Good Life Property Management (goodlifemgmt.com) The website of this San Diego-based property management company introduces it immediately as "not your typical property management company." They back that up with a focus on social proof, emphasizing over 1,000 reviews and highlighting dozens of resident and investor review videos. They also offer a clear list and map of zip codes they serve, along with a signup form for their landlord newsletter. Primary audience: San Diego property investors Standout features: Resident review videos; landlord newsletter 11. Luxury Property Care (luxurypropertycare.com) Luxury Property Care bills itself as “South Florida’s leading property management company.” The home page puts a clear focus on the financial aspects of real estate investment, highlighting rent collection and passive income. Its focus on offering high-end services is reflected in its mission statement: “Treat yourself to the luxury you deserve and let us handle every aspect of investing in off-market real estate and building a first-class rental empire with ease.” It’s also reflected in the website design scheme, with black and gold color elements being a popular way for brands to convey notions of elegance and prestige. Primary audience: Real estate investors in South Florida Standout features: Passive income messaging; SEO-friendly FAQ section How to improve your property management website Now that we've looked at some top-tier property management websites, let's identify some key takeaways that you can implement on your own site. Include a map of your coverage area Make it incredibly easy for prospective clients to know whether you're able to manage their properties. A map—and corresponding list of geographic areas—doesn't just make it easy for investors; it also minimizes the number of inbound calls and emails you'll get from clients whose properties fall outside your coverage area. Build social proof The best property management sites build trust through social proof. Consider embedding reviews in your website, filming testimonials, or adding case studies. Future residents or clients want to see that others have had a positive experience with you before trusting you with such a big piece of their lives. Lean into video Video content is more important than ever, helping boost your search engine optimization and how often you appear in responses on LLM tools like ChatGPT. You can also repurpose video content to share on your social media channels, expanding your online presence and making the upfront investment all the more worth it. Add an FAQ FAQ sections, either at the bottom of each page or on a page of their own, can help you show up more often in Google results. More importantly, they're a key element that AI search tools look at. They're easy for both algorithms and humans to read, so they make your site far more accessible. Make your call to action clear A bold button with a clear header gives users an easy way to take the next step, whether that's applying for a vacant home, scheduling a consultation, or paying rent. Be sure to avoid generic calls to action like "contact us" or "submit" unless they're supported by copy that makes it obvious what step they're taking and who it's intended for. You don't want residents accidentally asking for a rental analysis when they intended to apply for a home. Follow Second Nature to keep tabs on the property management industry At SecondNature.com, you’ll find an abundance of resources designed to keep you up to date on events, analysis, and expert perspectives in the field – all geared toward helping property managers create a “Triple Win” that benefits residents, investors, and property managers alike: Triple Win Property Management Blog Triple Win Property Management Podcast Triple Win Property Management Events Learn more about Second Nature’s Resident Benefits Package, which is designed to generate revenue and establish triple win conditions for your residents, investors, and business. If you want to see more about the impact of a true triple win, check out our Triple Win Impact Report, which dives deep into real results and data.

March 2, 2026

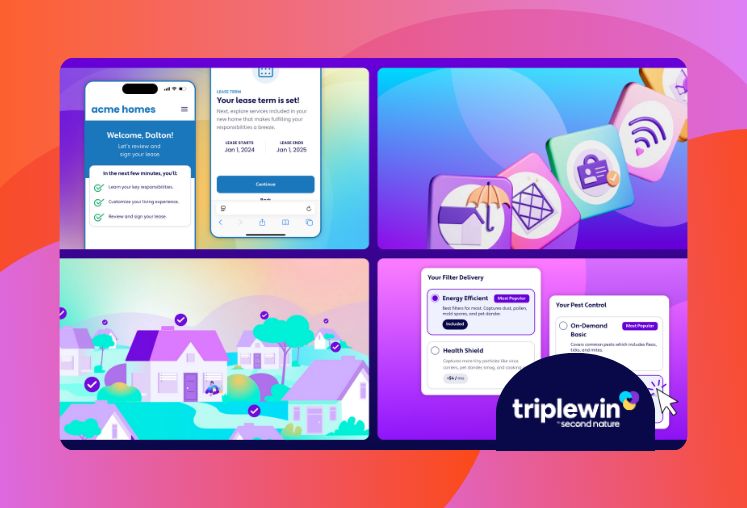

Read more